Need help?

Most frequently asked questions

4fund.com is a new online platform in which anyone can create fundraiser for any need be it social, medical or for business goals, just to name a few. It is run by the Polish company Zrzutka.pl sp. z o.o. which is the leading crowdfunding site in Poland with over 10 years of experience. Use of the portal is 100% free - both for Organisers and for Donators. It enables direct contact between Organisers and those who wish to donate. This platform provides the opportunity to raise funds for important life events such as weddings, and graduations to difficult and challenging circumstances like accidents and illnesses.

It only takes a few minutes to create a fundraiser! Describe and design your fundraiser, share it on social media to encourage donations and watch your dream come true.

A fundraiser campaign can be organised by any European Economic Area resident over the age of 18. Creating an account and running a fundraiser is 100% free - there are no fees!

On 4fund.com you can raise funds for almost anything, as long as it remains within the boundaries of law. You can raise funds money for charity, as well as for your private goals like gifts, a trip of a lifetime, veterinary costs etc. We do not judge your fundraiser’s purpose based on political or social beliefs and it is not up to us, but to your Donators, to decide whether it is worth donating for. Still, there are some activities that are prohibited on 4fund.com - read more.

Based on the permit issued by the Polish Financial Supervision Authority (KNF) on October 14, 2019, we are acting as a licensed payment services provider entered into the register of payment services providers under number IP48/2019. This status obliges us to ensure the highest safety standards for your payments and data.

Find out more at 'Safety & Security' tab.

Below we have listed the most important rules for safe use of 4fund.com:

- Only log in to 4fund.com on a trusted device using secure Wi-fi networks. Do not log in to your 4fund.com user account on public networks such as shopping malls, restaurants, train stations, airports, etc.

- Take care of the security of the devices you use: do not share them with third parties, do not leave them unattended, use anti-theft protection, use reputable anti-virus software and remember to keep them updated.

- Once you have logged in to 4fund.com, do not leave the device you are using. When you have finished your activities, remember to log out.

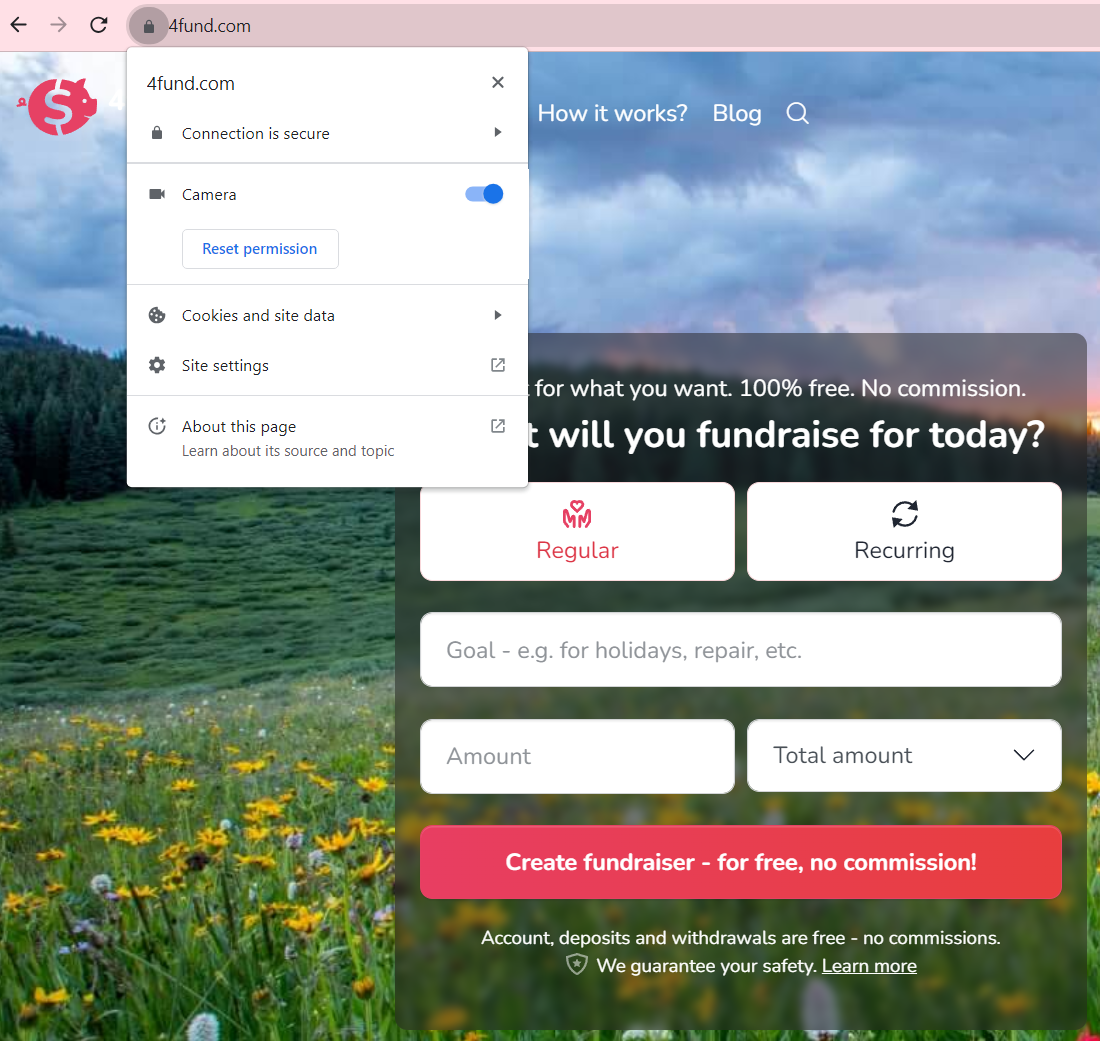

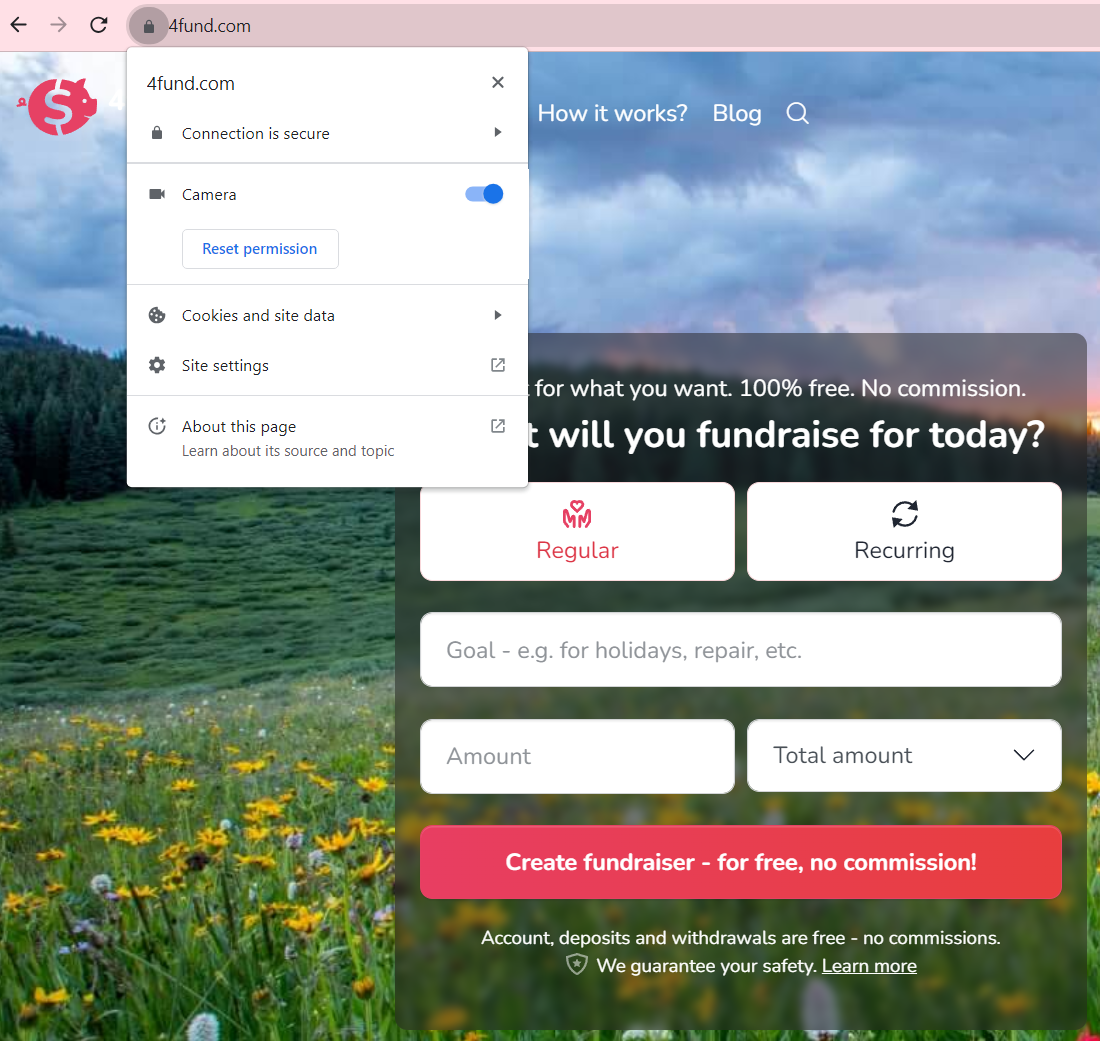

- Always check that your browser shows the address "https://4fund.com/" - no typos or misrepresentations, the address must start with "https://" and not "http://" or the padlock icon, when you click on it you will see information about the entity for which the security certificate has been issued (in our case, the certificate issued is for Zrzutka.pl sp. z o. o.):

- If the address is different (e.g. fourfund, forfound etc.), this means that someone is impersonating our site to commit fraud - be sure to let us know if you see such a situation! The same applies if there is no padlock or 'https://'.

- Take care of your login password.

- Create a strong password for your user account on 4fund.com

- At 4fund.com we require your password to consist of a minimum of 8 characters, one lowercase letter, one uppercase letter and a number or special character.

- Remember to change your password regularly. We will remind you every 90 days to change it.

- Do not share your login password with anyone. If there is a possibility that someone could have seen your password, change it immediately.

- Do not keep your password in a place accessible to others, e.g. on a piece of paper, in a notebook, in a calendar, etc. It is advisable to use a password manager, which makes it easier to remember and encrypt passwords.

- We recommend that your password on 4fund.com is unique (different from your password for e.g. mail, Facebook, etc.), so that you remain safe in case your data is leaked from any portal. It is therefore important that passwords are different.

- Confirmation of sensitive operations, e.g. the first verification of an Organiser's account, withdrawal history older than 90 days, making refunds, etc., will require confirmation by a code from an email or SMS code. You will set the authorisation method in the "Limits and authorisations" tab.

- Under the 'Limits and authorisations' tab, it is also worth setting a limit on daily withdrawals, as well as SMS notifications for high withdrawals.

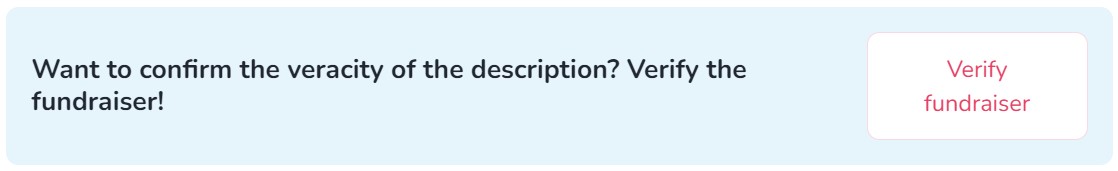

- As a Donator, remember to follow the principle of limited trust. Before making a donation, check that the Organiser of the fundraiser is verified. For charity fundraisers, it is worth noting whether it has an icon confirming the reliability of the description. A fundraiser with such an icon has a description verified on the basis of medical documents etc. sent by the Organiser.

General

4fund.com is a new online platform in which anyone can create fundraiser for any need be it social, medical or for business goals, just to name a few. It is run by the Polish company Zrzutka.pl sp. z o.o. which is the leading crowdfunding site in Poland with over 10 years of experience. Use of the portal is 100% free - both for Organisers and for Donators. It enables direct contact between Organisers and those who wish to donate. This platform provides the opportunity to raise funds for important life events such as weddings, and graduations to difficult and challenging circumstances like accidents and illnesses.

It only takes a few minutes to create a fundraiser! Describe and design your fundraiser, share it on social media to encourage donations and watch your dream come true.

A fundraiser campaign can be organised by any European Economic Area resident over the age of 18. Creating an account and running a fundraiser is 100% free - there are no fees!

On 4fund.com you can raise funds for almost anything, as long as it remains within the boundaries of law. You can raise funds money for charity, as well as for your private goals like gifts, a trip of a lifetime, veterinary costs etc. We do not judge your fundraiser’s purpose based on political or social beliefs and it is not up to us, but to your Donators, to decide whether it is worth donating for. Still, there are some activities that are prohibited on 4fund.com - read more.

Setting up a fundraiser

You can create fundraiser in a few seconds by filling out the form on our home page.

Take a look at our guide 'How to organise a fundraiser successfully? Guide and checklist for Organisers' in which we described the first steps on 4fund.com, and familiarise yourself with fundraiser editing instructions.

Choosing the right image for a fundraiser cover can be crucial in attracting potential Donators and creating a positive impact for your cause.

Consider the following:

- Relevance: The image should be relevant to your cause and clearly communicate the message you want to convey.

- Emotion: The image should evoke emotions that align with your cause and encourage people to donate.

- Quality: The image should be of high quality and visually appealing. Poor quality images can detract from your message and may not encourage people to donate.

- Originality: If possible, choose a unique image that stands out from others. This can help your fundraiser get noticed and make a greater impact.

Ultimately, the image you choose should inspire people to donate your cause and feel good about donating to it.

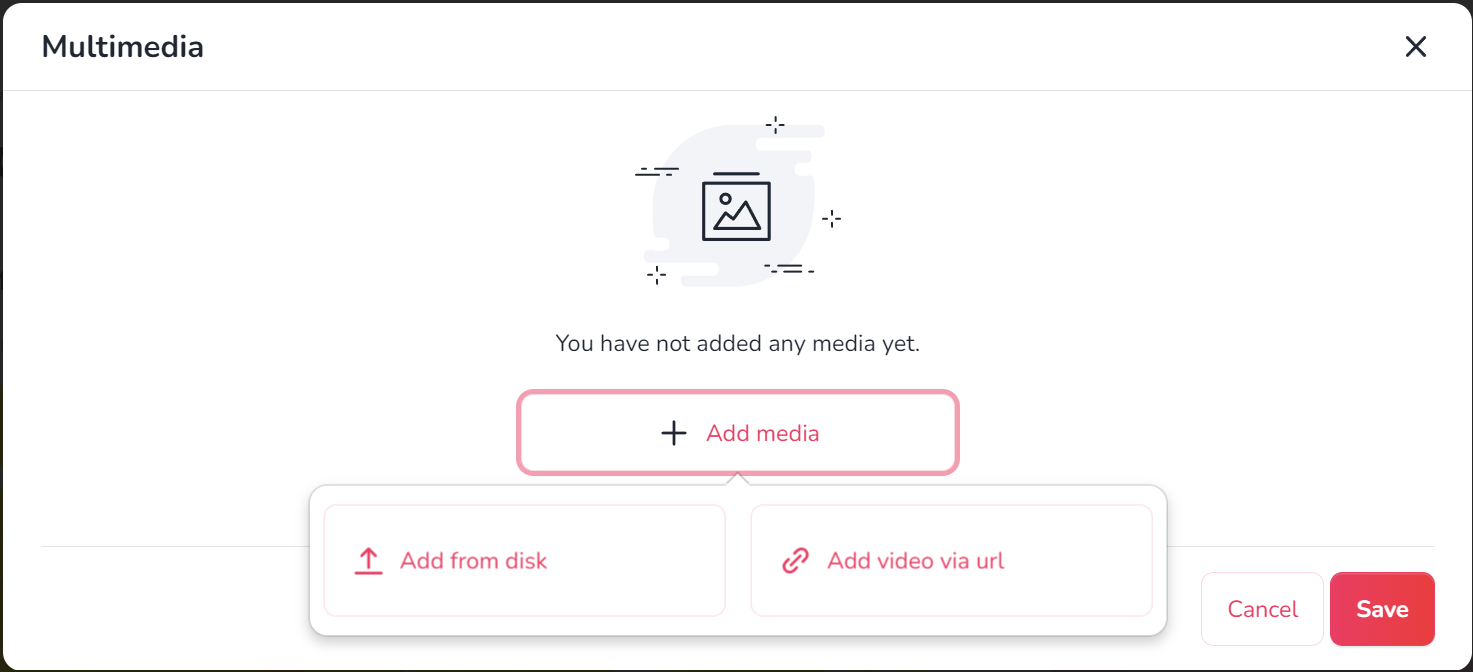

And one more thing - the cover of your fundraiser doesn't have to be an image - you can also use a video. You can include the video in your fundraiser gallery via an external link - it's not possible to upload it directly to 4fund.com. In order to place a film in the gallery of your fundraiser, upload it to any external portal (e.g. Youtube) and use the option 'Add video via url'.

The title of your fundraiser is an important part of your campaign as it's one of the first things potential Donators will see. A good title should be clear, concise, and compelling. Here are some tips to help you come up with a great title for your fundraiser:

- Be specific: Your title should clearly convey the goal of your fundraiser. For example, instead of 'Help Us Raise Money', try 'Fundraising for Local Animal Shelter.'

- Use emotive language: Choose words that elicit emotions and encourage people to take action. For example, 'Support Children's Education in Urban Areas' is more compelling than 'Raising Funds for Schools'.

- Make it catchy: A catchy title can grab people's attention and encourage them to learn more about your fundraiser. Try using alliteration, rhymes, or puns to make it more memorable. Keep it short: Your title should be short and easy to remember. Ideally, it should be no more than 10 words.

- Highlight the impact: If possible, include the positive impact that your fundraiser will have on your cause. For example, 'Help us Feed 100 Homeless People This Thanksgiving'.

- Use relevant hashtags: Use relevant hashtags to increase the visibility of the post and reach a wider audience. Examples of relevant hashtags could be the name of the organisation, the name of the cause, or a general hashtag for charitable giving. Examples: #Billy'sHeart, #TeamGeorge

The description of your fundraiser is an important element which can help Donators really understand the goal of your fundraiser, specifically why it’s important. We have compiled a list of our recommendations of what to include:

- Make it personal- share your personal story that helps to illustrate why this is important, this helps Donators connect emotionally and empathise.

- Keep it well divided into paragraphs so that it is easy to read-people can be discouraged by a big volume of text that is not organised or easily digestible.

- Opt for multimedia! Intersperse your description with images, videos, graphics... you are only limited by your imagination!

- And most importantly - tell the truth. Your fundraiser will be seen by both strangers and acquaintances. The latter will be able to catch the odd inaccuracy very quickly so transparency is key.

Interruption of the fundraiser does not involve any financial consequences.

Editing the fundraiser

As an Organiser, you have many options to edit your fundraiser. You can add basic information such as target amount, image and description, or you can expand it a bit more by adding useful links, location, news, rewards and rewards posts. All settings related to the above-mentioned functionalities you can find in the fundraiser view.

After logging in, the Organiser sees their fundraiser slightly differently than other users - along with all editing options (they are marked with a pencil or gear icon).

We have described each of the editing options in more detail in separate sections. Click below to find out exactly how to edit:

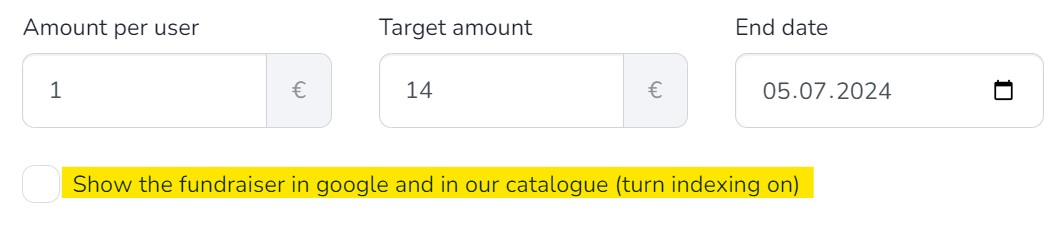

At 4fund.com we understand the need to be careful with your information due to privacy concerns. Switching to a private fundraiser means that your fundraiser will be removed from public search directory and will only be visible to those with whom you have shared your fundraiser link. However, please keep in mind that if your fundraiser's direct link is posted on social media accounts, such as Facebook, WhatsApp etc. anyone who clicks on your fundraiser link will be able to access the fundraiser. To create a private fundraiser, just uncheck the checkbox in the window for editing the basic information of the fundraiser 'Show the fundraiser in Google and in our catalogue (turn indexing on)'. This will make your fundraiser visible only to people you share the link with.

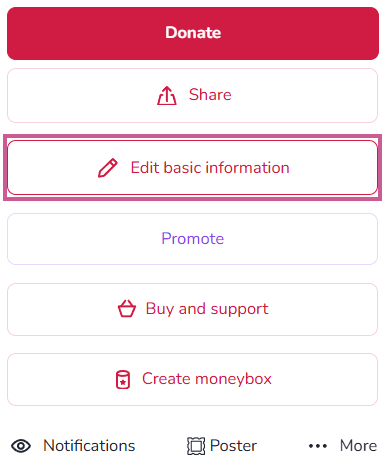

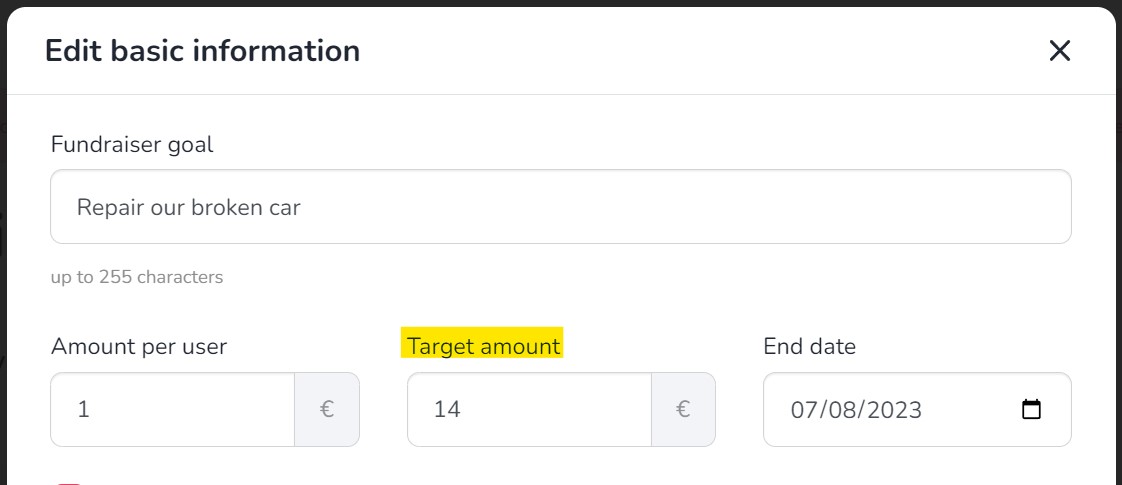

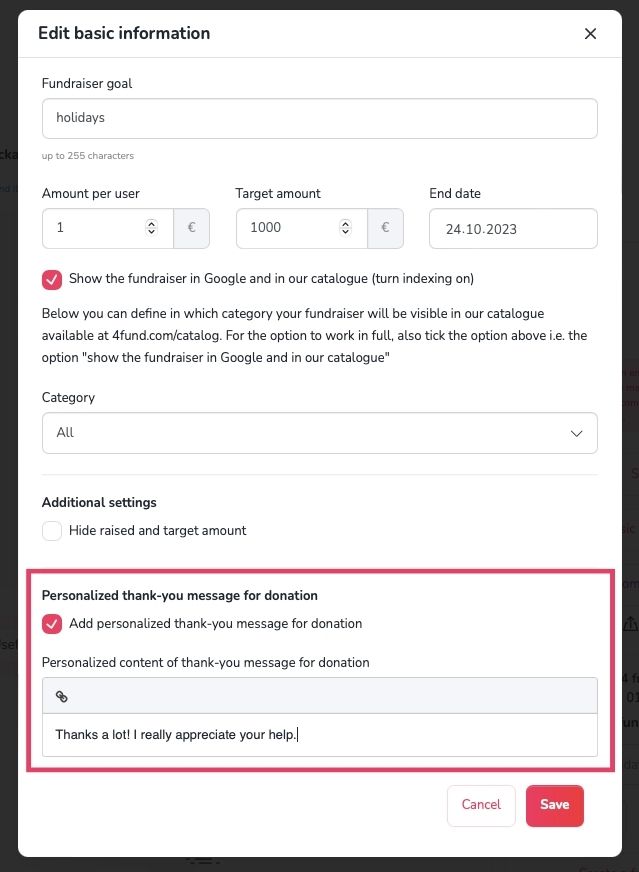

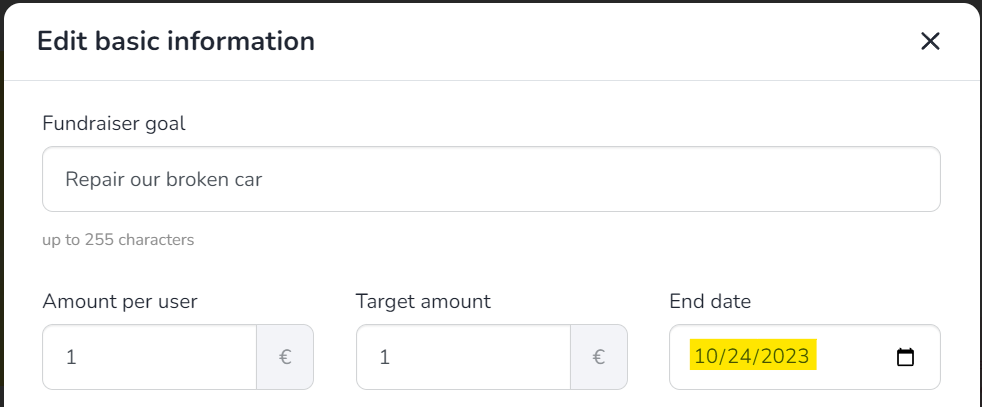

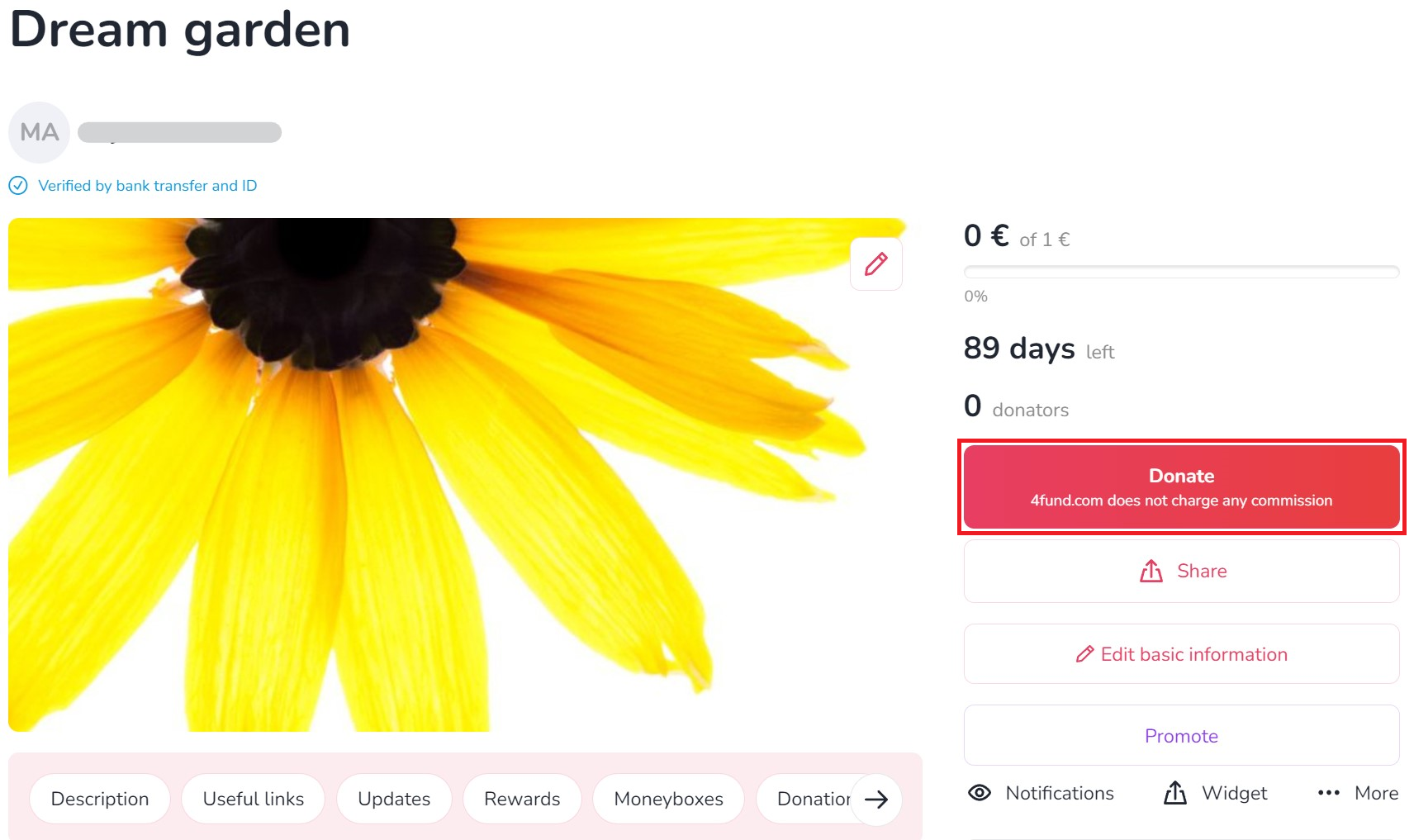

Once you log in to your fundraiser's page, you will see a button 'Edit basic information' on the right side of the image.

Clicking on it will allow you to edit the following data:

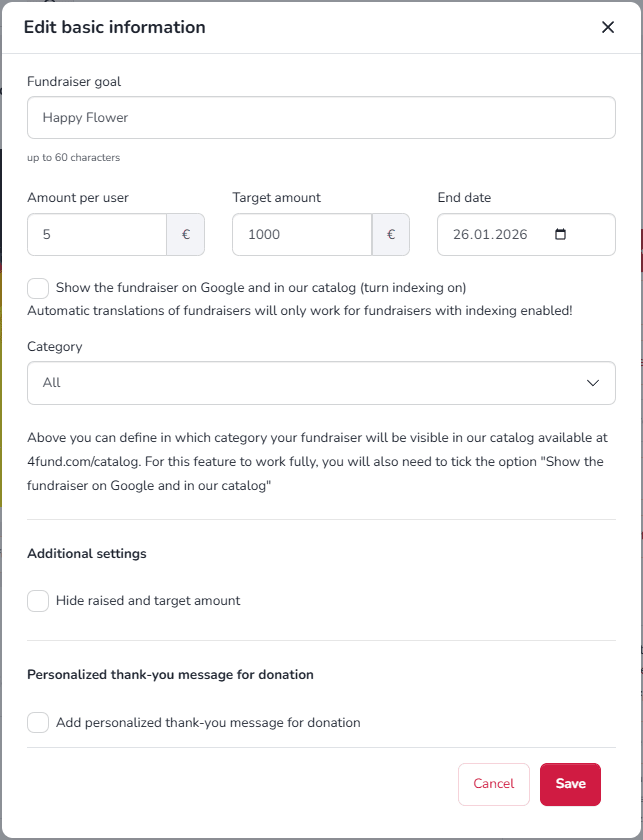

- The goal of the fundraiser, which is its title. In this section, you should write a headline that will be visible in the directory and preview. The goal should be short and catchy - a detailed description of what the funds is being raised for should be included in the fundraiser's description.

- Minimum donation amount, which refers to the smallest or lowest amount of donation that can be donated to a particular cause. The total amount is the sum you want to raise and can also be hidden from Donors - just check the checkbox.

- End date of the fundraiser - it is set to 90 days by default, but you can change it at any time.

- By checking the 'Show the fundraiser in Google and in our catalogue (turn indexing on)' checkbox, you will allow it to be displayed in our fundraisers catalogue and in search engines such as Google.

- Category is the tab in our directory where your fundraiser will be displayed.

- Thank you message for Donors - after checking the appropriate box, a field will expand where you can enter your own thank you message that will be displayed to every Donors after they make a donation to your fundraiser. In the thank you message, you can also add a link (e.g. to a YouTube video or images gallery) - to do this, select the text that should lead to the opening of the page and click the icon visible in the upper left corner of the text field.

After you finish editing, click 'Save' to save the changes.

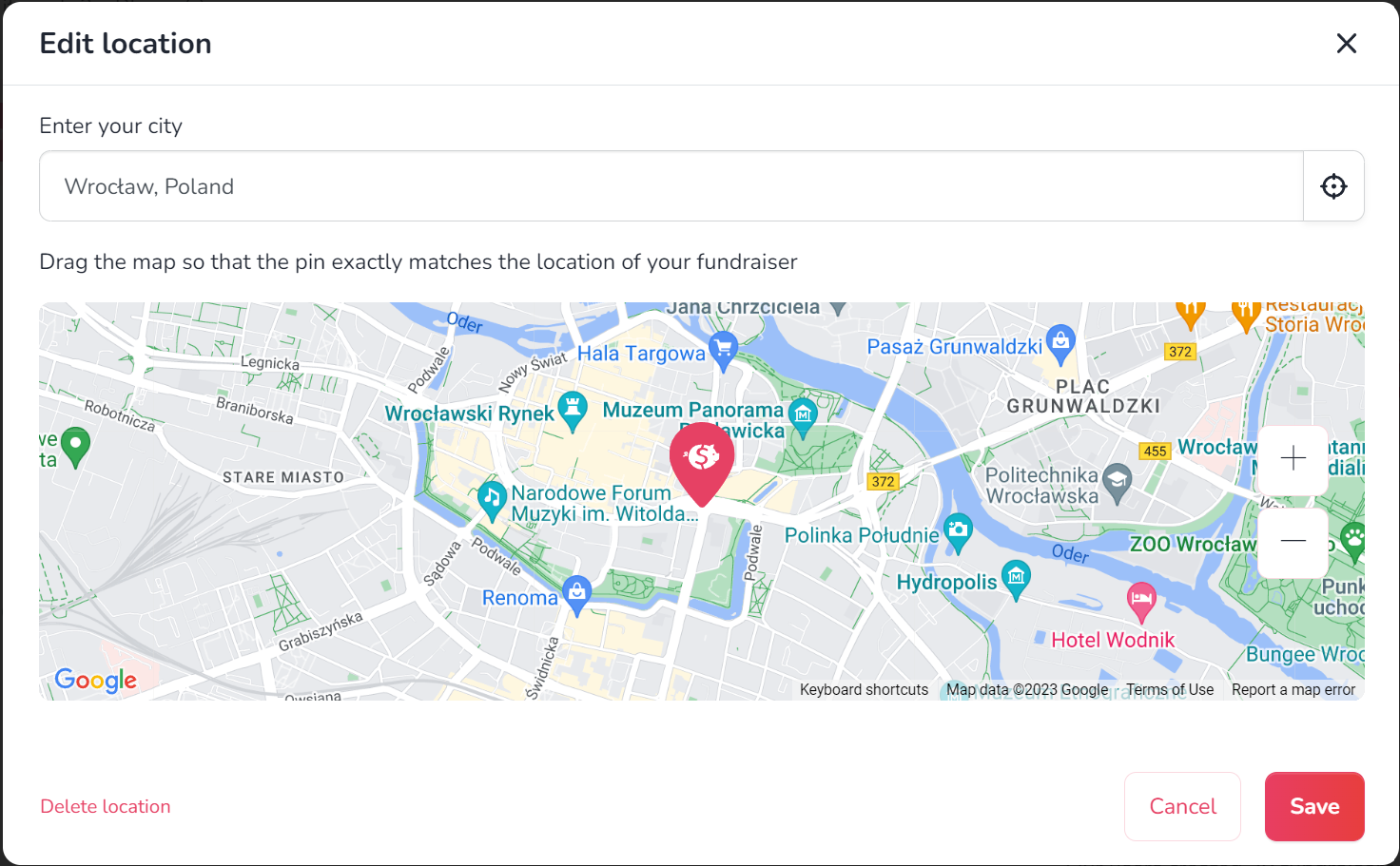

You can let your Donators know where you are by adding your location to your fundraiser. To do this simply click the pencil icon in the "Location" just below the fundraiser description.

You can enter the location in the search bar or mark it on the map with a pin.

Possible Donators can find your fundraiser by its location in fundraisers catalogue using location search.

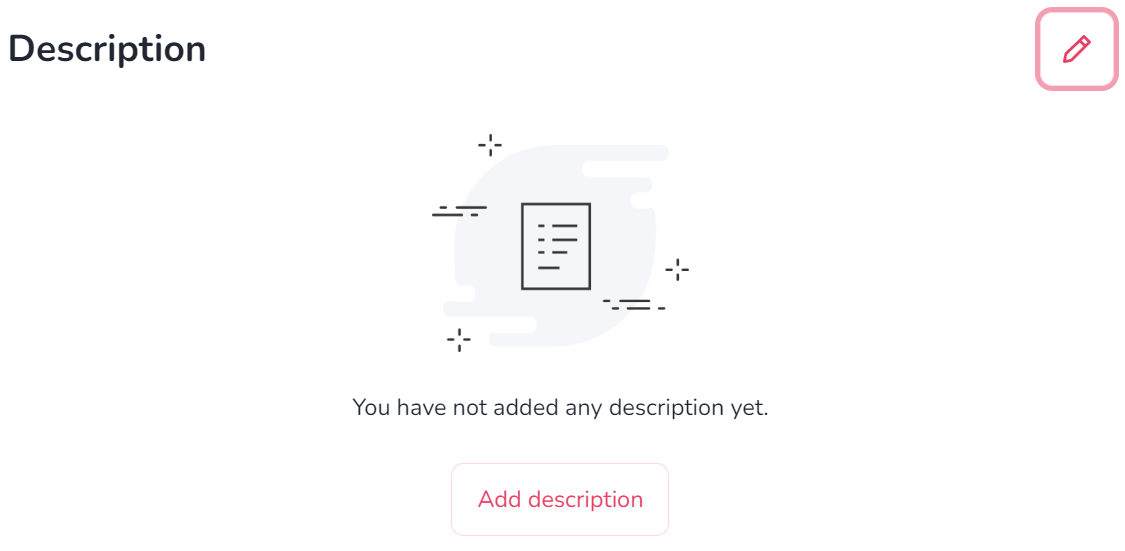

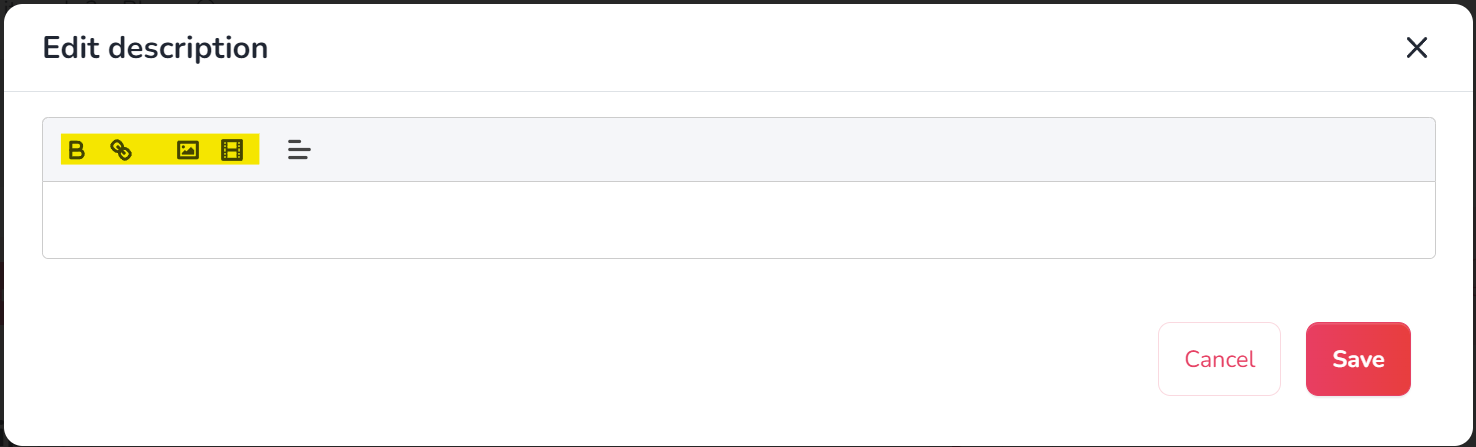

To edit the description of your fundraiser, log in and click the pencil icon in the upper right corner of the description field.

In addition to text, you can include image (image icon) or videos (film strip icon) in the description. Clicking the icon with the letter B will bold the highlighted text. To the right, there is an icon for adding a hyperlink, which is a link that will open when the selected text is clicked.

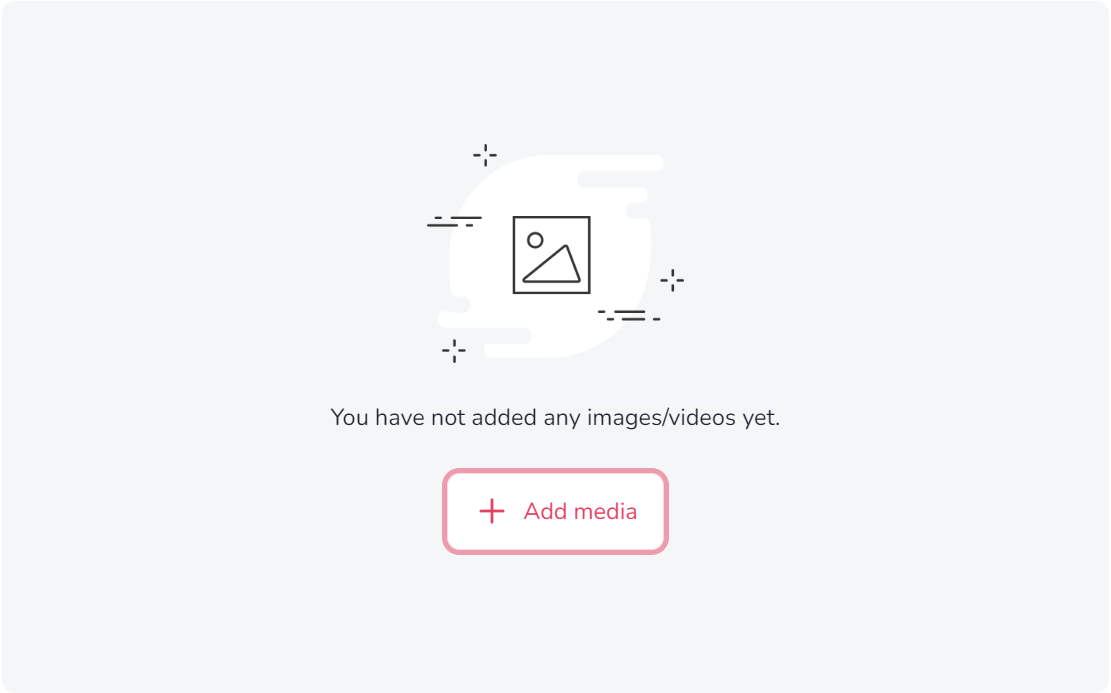

- If your fundraiser does not have any image yet, use the 'Add media' option:

- If you want to add additional images to a fundraiser that already has media, click the pencil icon in the top right corner of the image.

- When adding a image, a menu will appear where you can upload a image from your computer or add a URL of a video that you want to display in the fundraiser's gallery.

- A good image should have a minimum size of 750 x 420 px. When adding a image, you can also rotate it and crop it using a slider to make it look its best on the fundraiser.

- At this point, you can also change the order of media in the gallery by moving them. The first image or video will be displayed in the preview of your fundraiser.

After finishing the editing, click 'Save' to save the changes.

A list of Donators is just below the moneyboxes in the view of your fundraiser.

There, you can easily change the way donations are sorted - from the most recent or from the highest deposit. In addition, by clicking on the gear icon, you can also hide the amount or details of all your donates, as well as enable recurring donations.

You can change the target amount of your fundraiser freely in the 'Edit basic information' section of your fundraiser page.

In case the description of your fundraiser has already been verified and the editing of the description has been blocked, in order to increase your fundraiser target please contact our customer service.

Fundraiser management

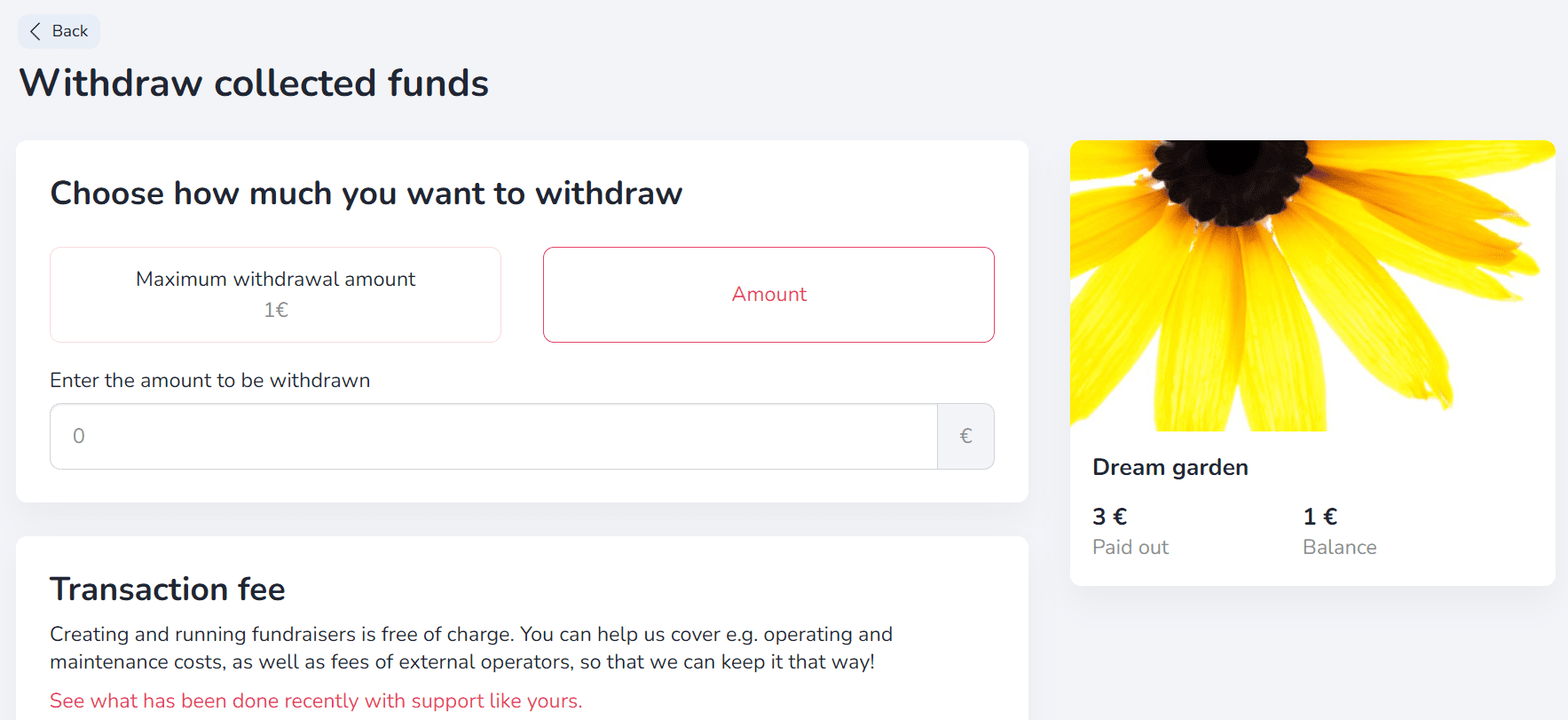

After logging into your profile, you will only see the option to withdraw to a payment card. If you experience any issues with this, please contact us - we will guide you on how to withdraw funds via a traditional bank transfer to your bank account.

You can find the updates functionality right below the description field. To add updates, click on the '+' button. After adding the first content, the updates section will automatically move above the description.

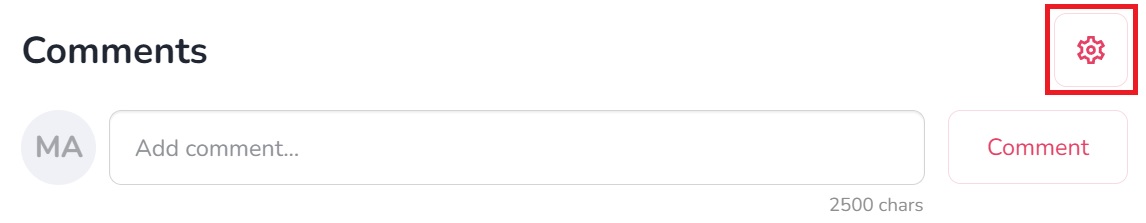

You can find the comment settings by clicking on the gear icon in the 'Comments' section at the bottom of your fundraiser view. As an Organiser, you can decide who can add comments (everyone, only Donators or no one) and delete comments that you consider unwanted. Like any other user, you can also add your comments, replies to other comments, and reactions with emoticons.

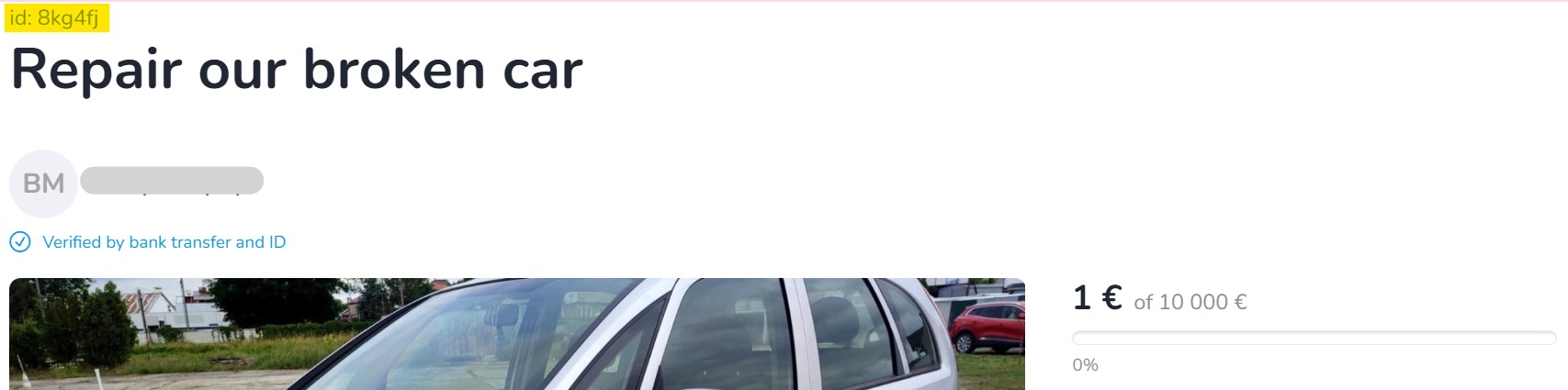

Every fundraiser created on our portal receives its individual ID number, a unique string of six characters. You will always find the ID number of a fundraiser just above its title.

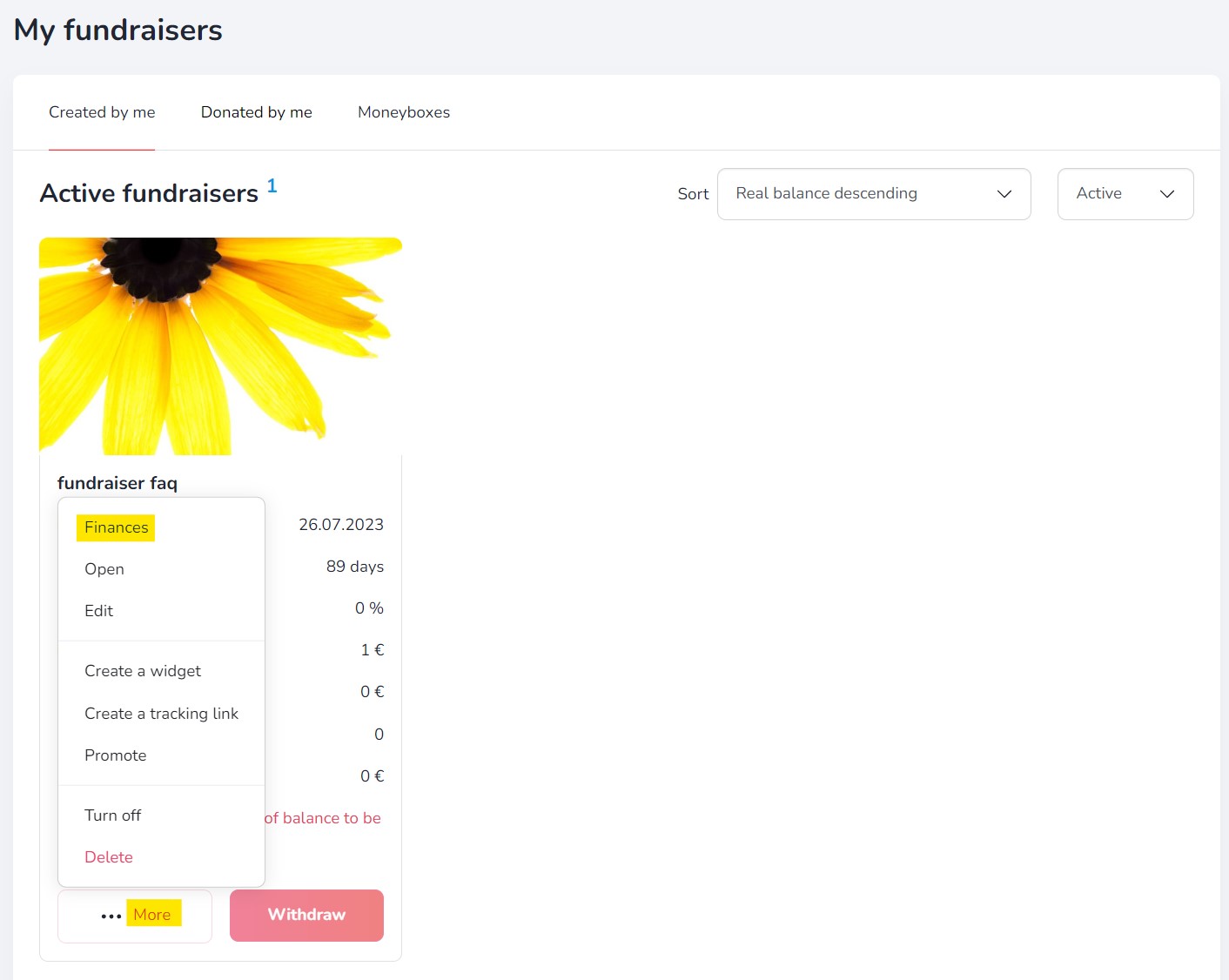

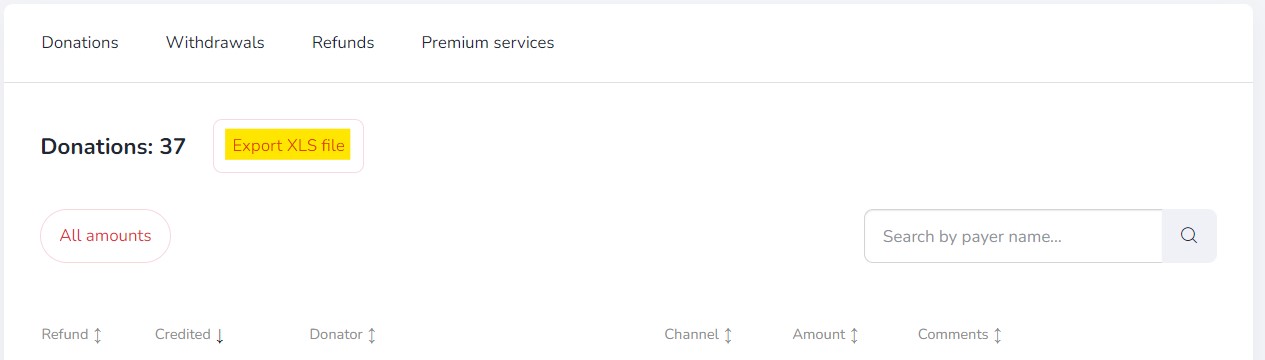

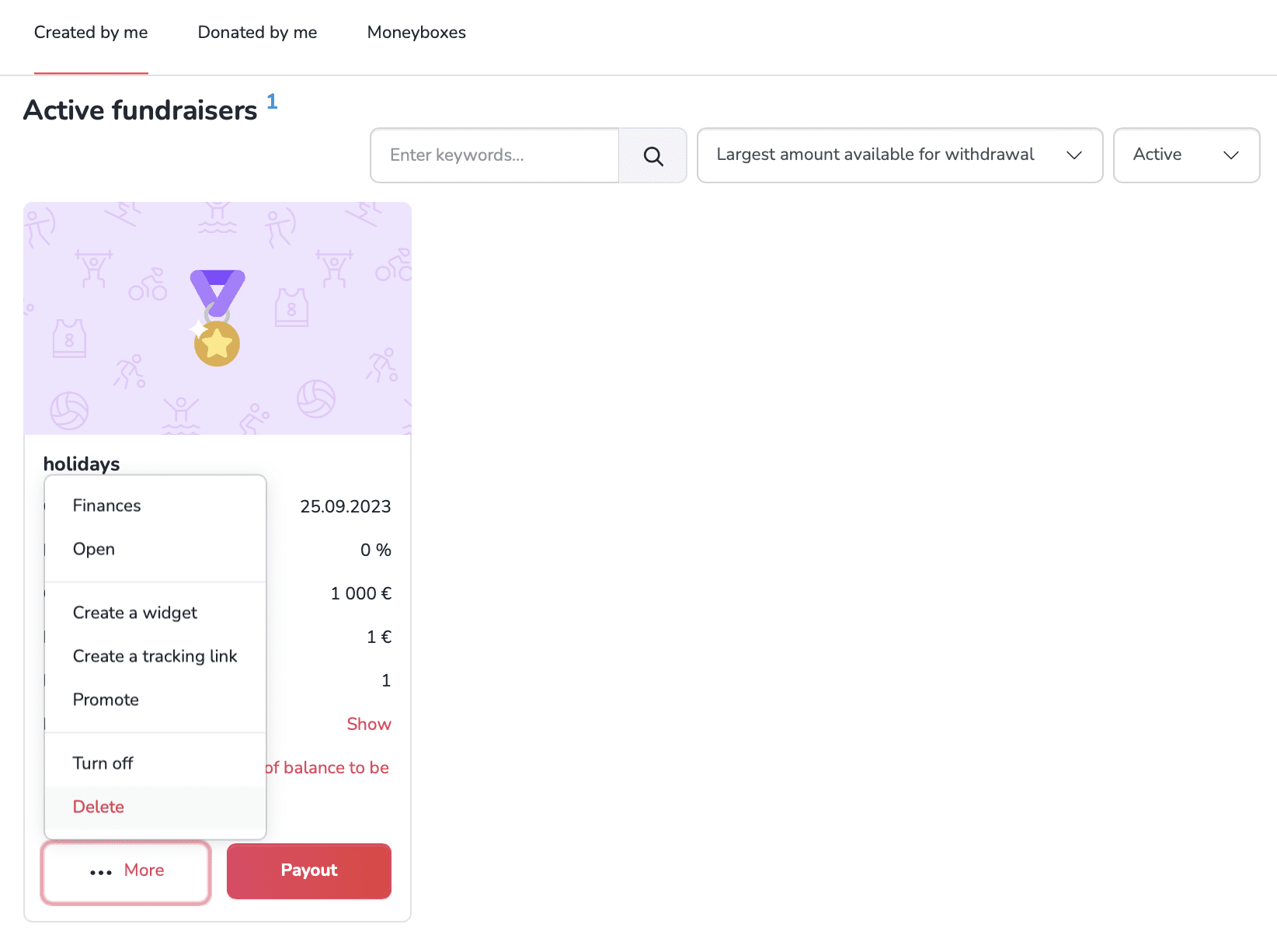

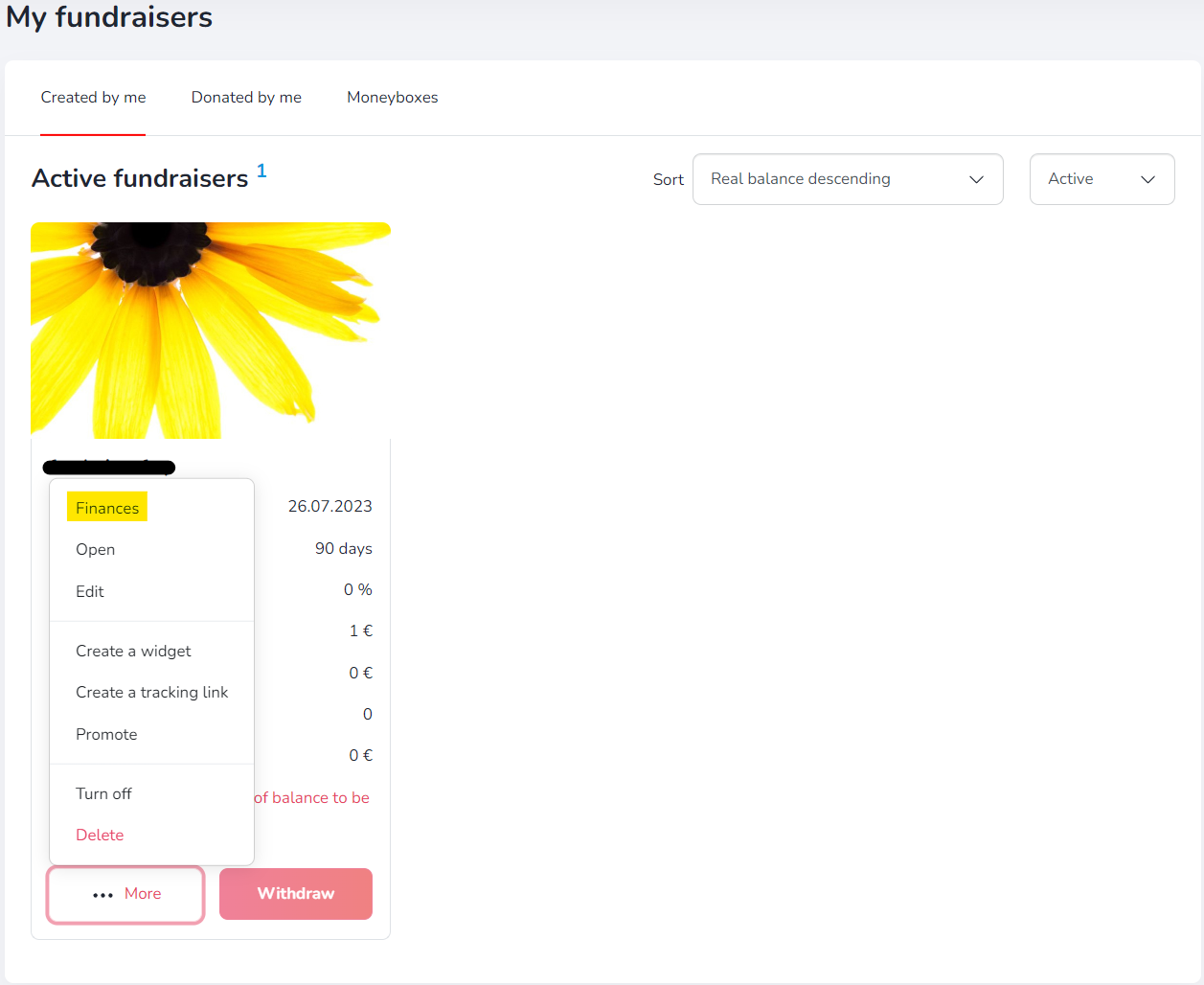

You can view Donators details by generating a donations summary (even for anonymous and unregistered Donators). Just go to 'My fundraisers' tab -> click '...More' -> 'Finances' -> and 'Export XLS file'.

In the donation summary you will find a complete list of Donators to a given fundraiser, including the amount of the donation, the payment method, the email address given when making the donation and other data (if available).

Additional features

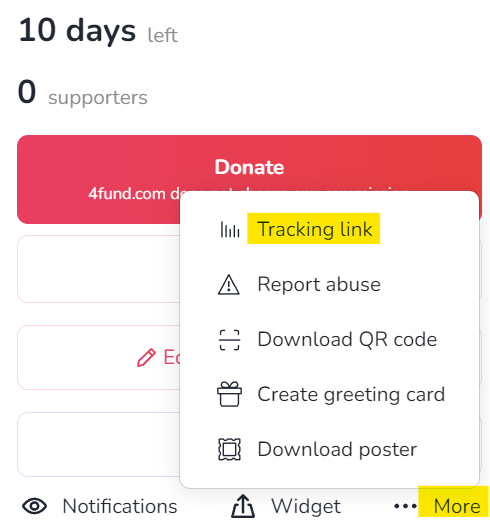

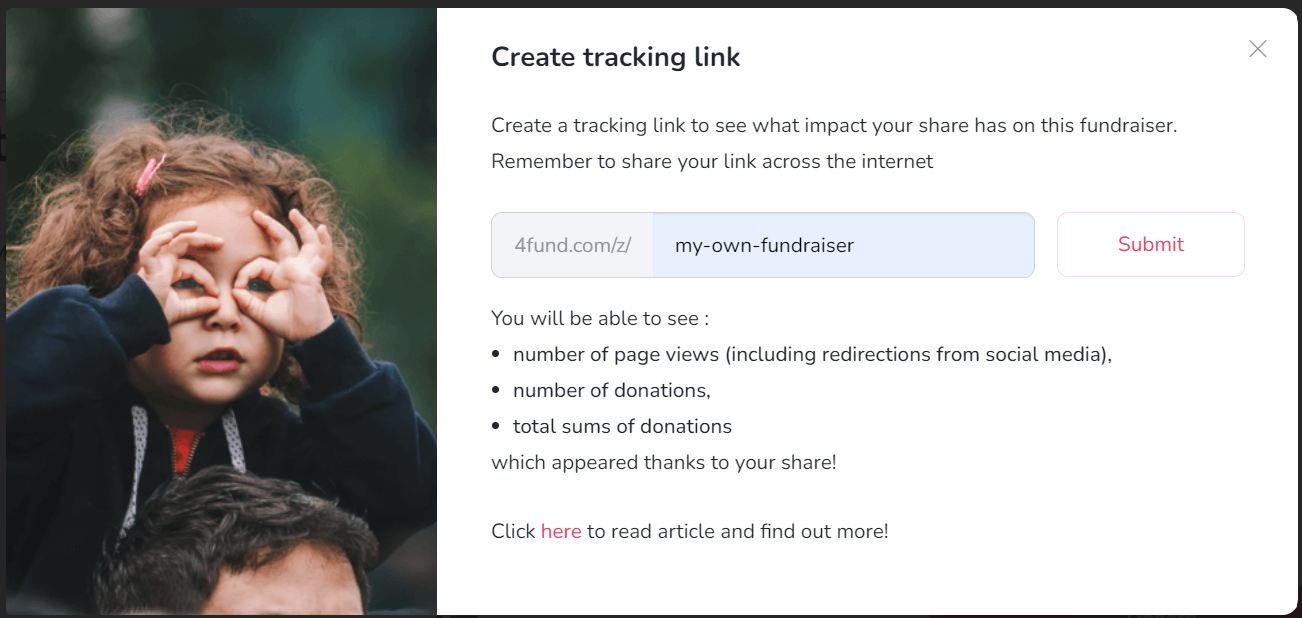

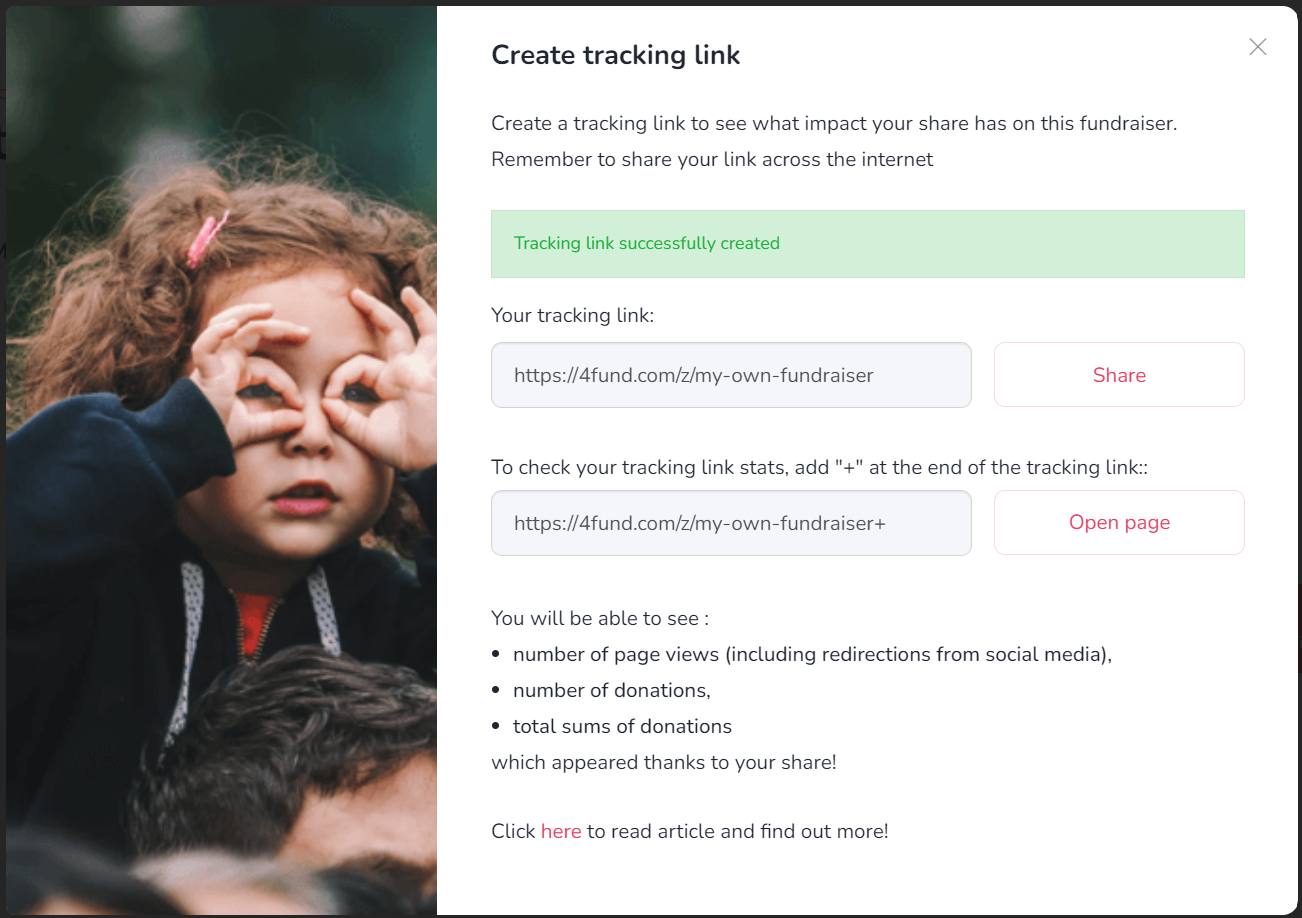

If you want to create your own tracking link that will show you statistics of clicks and donations, press the 'More' button on the selected fundraiser, and click "Tracking link":

Chose and write your own tracking link or click in "Random" button to generate random string:

Now click the 'Submit' button:

To check how many people clicked on the link and how many donations were made using that link, add the '+' sign at the end (e.g. 4fund.com/z/my_fundraiser+). You can create multiple tracking links for each fundraiser.

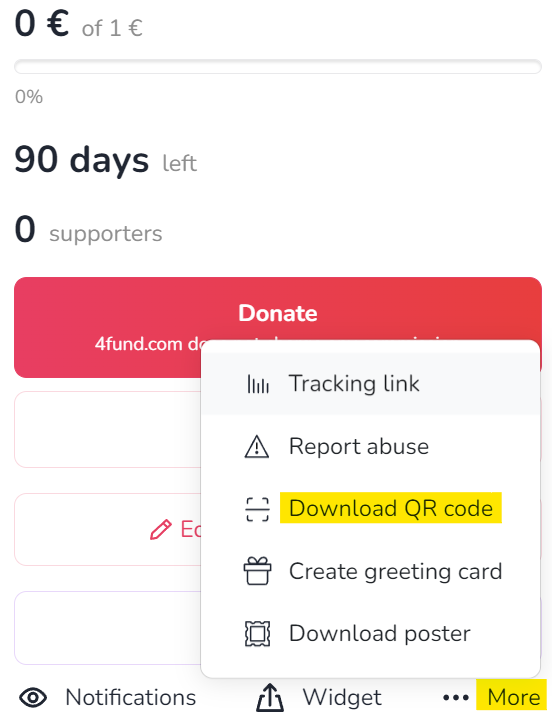

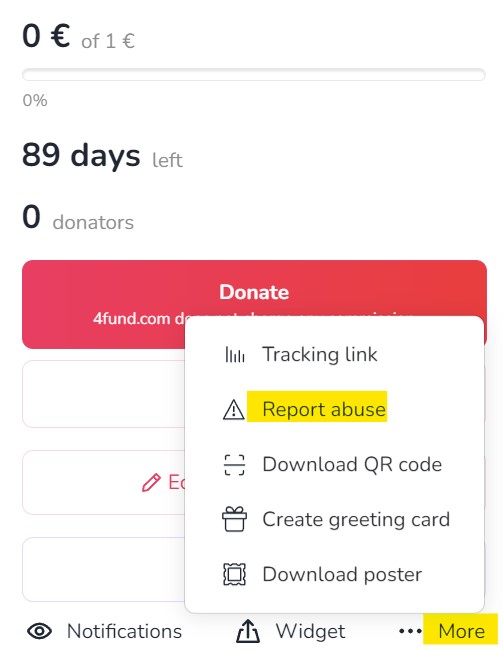

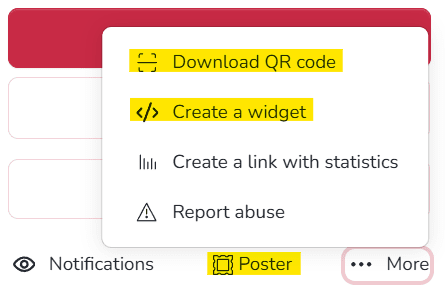

You can generate a QR code for each fundraiser. Just take a photo of it and this will allow you to access its details or to go directly to the payment. You can place the QR code on anything physical: posters, leaflets, presentations, billboards, or by showing your friends on the phone screen. You can forget about dictating the address of your fundraiser - click on the fundraiser page '...More' -> 'Download QR code' and you're done

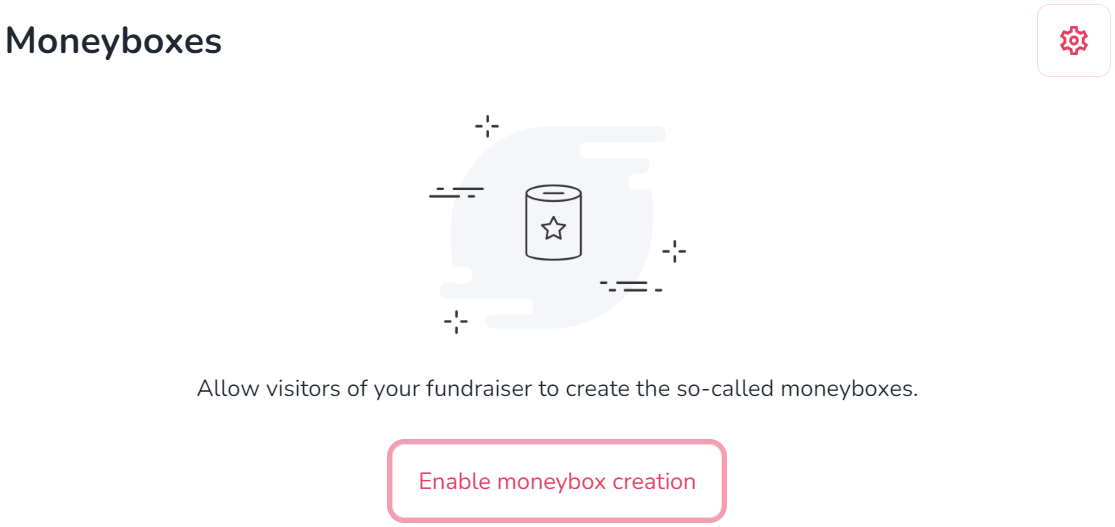

The moneybox on 4fund.com works like an online donation box - employees of a specific company, fans of a particular celebrity, or people gathered in one Facebook group can transfer donations to it and watch how much funds they managed to raise. The person creating the moneybox appears as the Organiser and can edit its description, link, as well as thanks for the payment. All the funds raised in the moneybox are credited to the balance of the main fundraiser. An important detail is when you create a moneybox for someone else's fundraiser, you don't have to verify your account!

The moneybox section is located in the fundraiser view under the rewards posts. To allow users to create moneyboxes for your fundraiser, click 'Enable the ability to create moneyboxes'. You can also create a moneybox yourself by clicking 'Add moneybox'.

If you want to show gratitude for a donation you have received, you can create your own personalised ‘thank you’ for the donation and set its content in the fundraiser 'Edit basic information' section. Posting updates is also a great way to keep your Donators in the loop and connected.

Creating a fundraiser is a very simple operation. A basic fundraiser can be created in less than 30 seconds! However, for professional and more demanding users, we have prepared a few interesting solutions, like tracking link, moneyboxes, rewards, widgets, QR codes and much more. All advanced functionalities of 4fund.com have been collected for you in this blog article. Enjoy reading!

End of fundraiser

You can change the end date of your fundraiser at any time. To extend the duration of your fundraiser, just click the 'Edit basic information' button on your fundraiser page - just enter a new end date in the 'End date' field and click 'Save'.

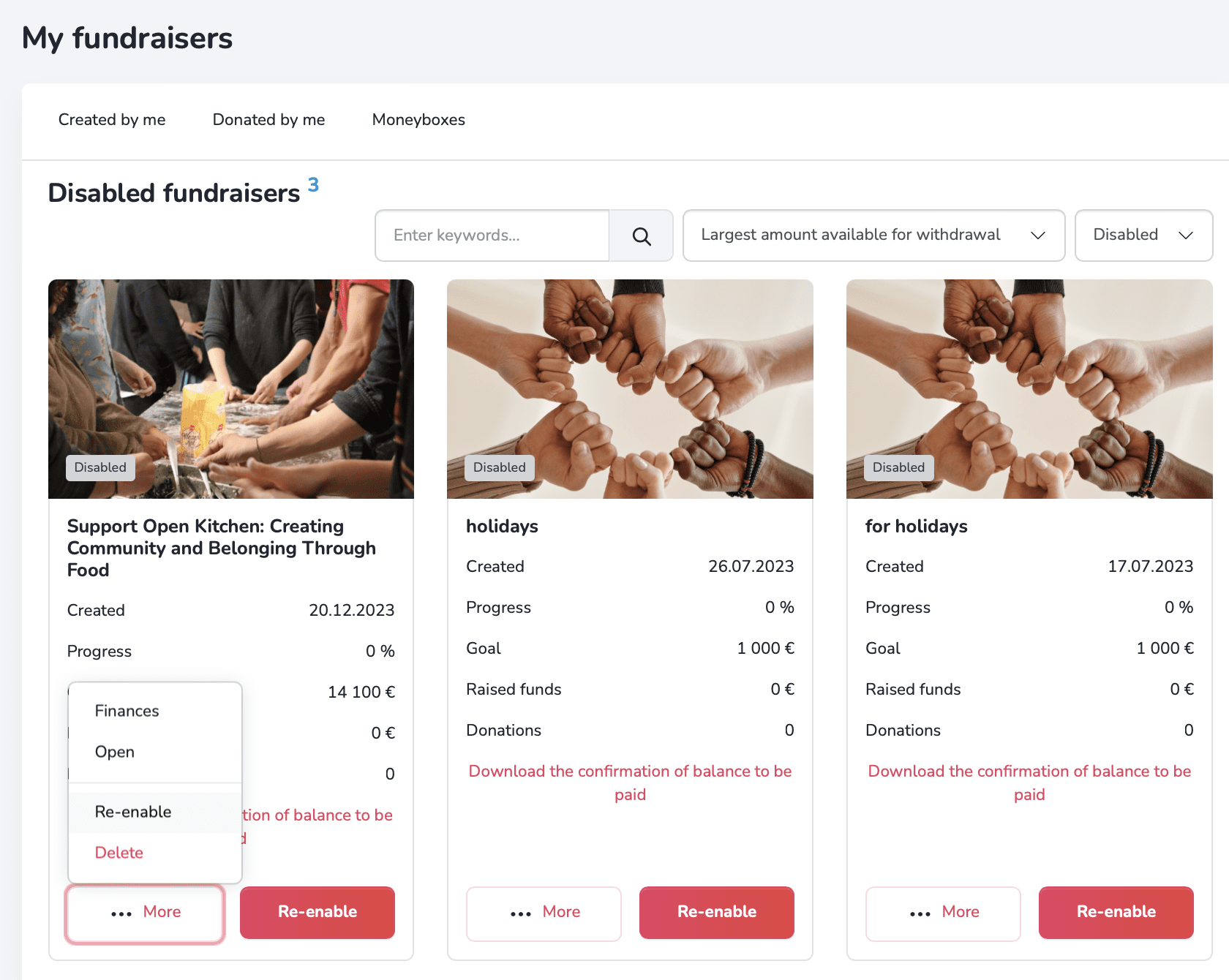

If you want to delete your fundraiser, posting a final update is a great way to let your Donators know that you're closing the page. Then after that you can disable or completely delete your fundraiser at any moment in the 'My fundraisers' tab. Just press the 'More' button, visible in the bottom left corner of the preview of your fundraiser. Select 'Turn off' or 'Delete' from the drop-down menu.

Please keep in mind:

A disabled fundraiser remains visible to visitors, but donations will no longer be possible. A disabled fundraiser can be re-enabled at any time. On the other hand deleting the fundraiser will prevent the visitor from seeing its content. A deleted fundraiser cannot be re-enabled.

In order to re-enable the fundraiser, go to the 'My fundraisers' tab and set the 'Disabled' filter - then select the 'Enable' option from the drop-down menu in the fundraiser preview.

Other

There are some activities that are prohibited on 4fund.com:

- You may not raise funds for any goal that would be illegal in your country or in Poland (the country of our registered office). Polish law does not prohibit most fundraiser's goals, but with one notable exception - you may not raise funds to cover fines or bail imposed in the criminal proceedings.

- The goal or the description of your fundraiser may not endorse, support or promote hatred, violence, discrimination, terrorism, fascism or other totalitarian regimes, or publicly condone crimes.

- You may not harm, slander or defame anyone through your fundraiser. This applies both to your fundraiser’s goal and its description. You may raise funds to finance legal proceedings against someone (e.g. to pay lawyers fees), but if you indicate any circumstances that may defame someone in the description of your fundraiser, and that someone raises objections to us, you will have to prove that what you write is true with an appropriate official document (e.g. a relevant court judgment). Remember that 4fund.com is neither a court of law nor a place of dispute resolution.

- You may not raise funds to buy weapons (regardless of legality of such purchase).

- You may not raise funds to finance gambling, prostitution or pornography (regardless of legality of such activities).

- You may not use 4fund.com to finance or spread misinformation or fake news. If we find what you write in your fundraiser’s description doubtful, we will need you to prove it. Keep your fundraiser’s description true and verifiable.

- You may not offer shares in companies for donating to your fundraiser or construct a fundraiser where the donations would be treated as loans to you from your Donators. This is because we are a donation-based crowdfunding site, not an equity crowdfunding one - if your business plan includes such a solution, we suggest you use a specialized site.

Based on the permit issued by the Polish Financial Supervision Authority (KNF) on October 14, 2019, we are acting as a licensed payment services provider entered into the register of payment services providers under number IP48/2019. This status obliges us to ensure the highest safety standards for your payments and data.

Find out more at 'Safety & Security' tab.

4fund.com is licensed to provide payment services in the European Economic Area and, under this licence, is obliged to verify the identity of its customers. It is run by the Polish company zrzutka.pl which is the leading crowdfunding site in Poland.

There are two verification processes.

- Profile verification

- Fundraiser cause verification

We also use a global entity verification and background check company called Onfido. Their technology allows us to verify our users to the highest extent.

We also use a variety of methods to verify Organisers and ensure the legitimacy of fundraising campaigns. These include:

- Identity verification

- Biometric verification

- Review process

Thanks to these procedures, we know exactly who is raising funds on 4fund.com and we can take care of the right level of security.

For more information of verification process on 4fund.com, please visit our blog.

In order to keep your data as secure as possible, you can additionally make sure, that nobody is looking above your shoulder!

We verify the identity of all Organisers. In addition, in situations defined by our regulations (for example, when we exceed certain fundraising thresholds or when we receive applications for a particular fundraiser), we also verify the truthfulness of the goal stated in the description of the fundraiser, asking the Organiser to send us relevant documents to confirm it. In case we have doubts whether the funds from an ongoing or already completed fundraiser have been used in accordance with the Organiser's declarations, we can also check their spending by asking, for example, for transfer receipts, invoices or receipts.

If you have any doubts or concerns about a particular fundraiser, please contact the Organiser to confirm its reliability. You can also report abuse to the fundraiser, which will be analysed by our staff.

If you are concerned about the legitimacy of a fundraiser on our site, be sure to report it to us using the 'Report abuse' button. All such reports are analysed by our team. We are pleased that our users remain vigilant, as this enables us to detect any potential abuse more quickly and efficiently. Only fundraisers that violate our terms of use will be removed.

Below we have listed the most important rules for safe use of 4fund.com:

- Only log in to 4fund.com on a trusted device using secure Wi-fi networks. Do not log in to your 4fund.com user account on public networks such as shopping malls, restaurants, train stations, airports, etc.

- Take care of the security of the devices you use: do not share them with third parties, do not leave them unattended, use anti-theft protection, use reputable anti-virus software and remember to keep them updated.

- Once you have logged in to 4fund.com, do not leave the device you are using. When you have finished your activities, remember to log out.

- Always check that your browser shows the address "https://4fund.com/" - no typos or misrepresentations, the address must start with "https://" and not "http://" or the padlock icon, when you click on it you will see information about the entity for which the security certificate has been issued (in our case, the certificate issued is for Zrzutka.pl sp. z o. o.):

- If the address is different (e.g. fourfund, forfound etc.), this means that someone is impersonating our site to commit fraud - be sure to let us know if you see such a situation! The same applies if there is no padlock or 'https://'.

- Take care of your login password.

- Create a strong password for your user account on 4fund.com

- At 4fund.com we require your password to consist of a minimum of 8 characters, one lowercase letter, one uppercase letter and a number or special character.

- Remember to change your password regularly. We will remind you every 90 days to change it.

- Do not share your login password with anyone. If there is a possibility that someone could have seen your password, change it immediately.

- Do not keep your password in a place accessible to others, e.g. on a piece of paper, in a notebook, in a calendar, etc. It is advisable to use a password manager, which makes it easier to remember and encrypt passwords.

- We recommend that your password on 4fund.com is unique (different from your password for e.g. mail, Facebook, etc.), so that you remain safe in case your data is leaked from any portal. It is therefore important that passwords are different.

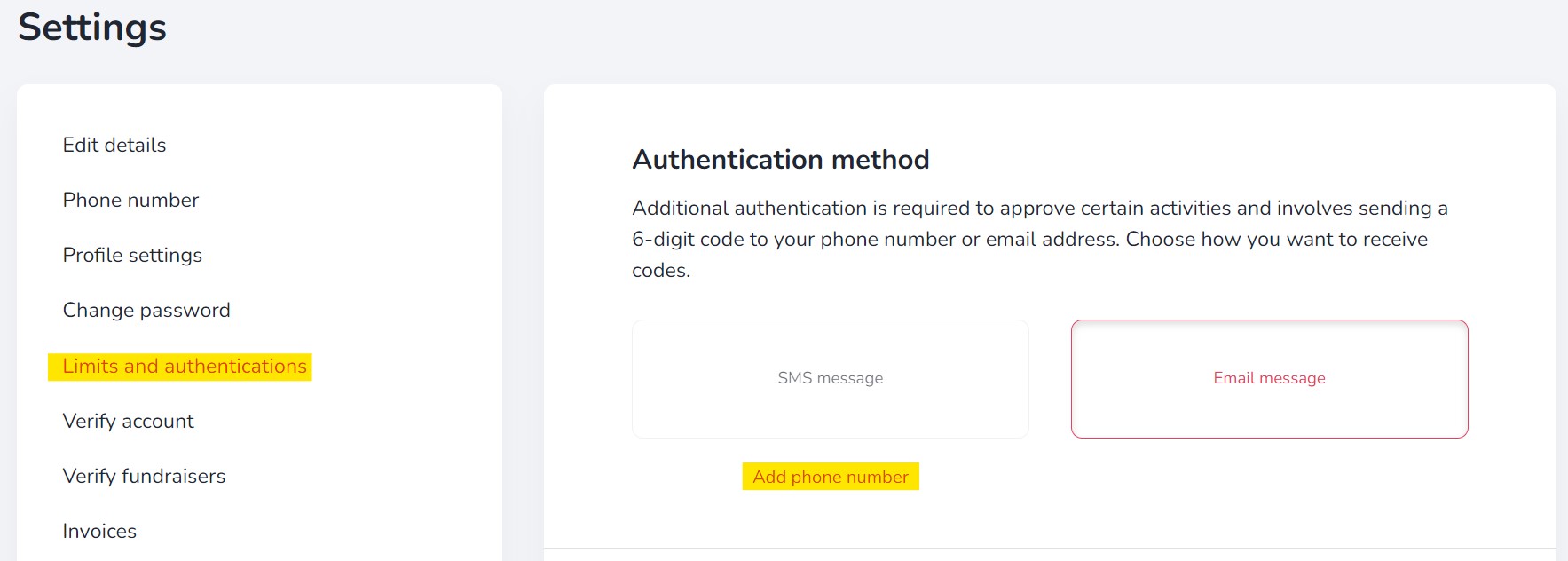

- Confirmation of sensitive operations, e.g. the first verification of an Organiser's account, withdrawal history older than 90 days, making refunds, etc., will require confirmation by a code from an email or SMS code. You will set the authorisation method in the "Limits and authorisations" tab.

- Under the 'Limits and authorisations' tab, it is also worth setting a limit on daily withdrawals, as well as SMS notifications for high withdrawals.

- As a Donator, remember to follow the principle of limited trust. Before making a donation, check that the Organiser of the fundraiser is verified. For charity fundraisers, it is worth noting whether it has an icon confirming the reliability of the description. A fundraiser with such an icon has a description verified on the basis of medical documents etc. sent by the Organiser.

The user can, at any time, block the installation of cookies, delete permanent cookies or otherwise modify the conditions for storing or receiving cookies by using the appropriate options of their Internet browser, i.e. Microsoft Edge, Mozilla Firefox, Google Chrome, Opera, Safari.

In each Organiser's profile on 4fund.com, just below the title and Organiser's name, you'll find information on how the profile has been verified.

Additionally, in the case of charitable fundraisers (for medical treatment, the aftermath of fires or animal treatment etc.) the fundraiser may additionally have a credibility icon. This means that the Organiser has sent us additional documents confirming the truthfulness of the description of the specific fundraiser.

Other

We do not provide tax advice. If you want to know more check with a tax professional to be sure or contact your country’s tax office.

There are no fees to start or manage your fundraiser. Creating and using an account on 4fund.com is 100% FREE for everyone. There are no fees on donatios or withdrawals.

People who donate will also not incur any fees or commission, regardless of the chosen payment.

100% of your donation goes to the Organiser of the fundraiser - there is no obligatory transaction fee. What's more - the Organiser also does not pay any fee to start or manage a fundraiser. Donators can help power 4fund.com with an optional support, but it’s never required.

Online payments are credited to the fundraiser almost immediately (it takes up to 5 minutes).

After the payment is credited, you will receive a confirmation email that you provided when making the payment. In addition, you can find your payment in the ‘Donators' tab visible on each fundraiser (unless the Organiser has hidden the data of the Donators).

You can withdraw funds at any time, even if your fundraising goal has not yet been reached. Please note that in order to withdraw funds, you must first complete your payment card details for withdrawals. If you experience any issues with withdrawing funds to your card, please contact us, and we will guide you on how to add a bank account for your withdrawals and withdraw funds via a traditional bank transfer.

NO. The withdrawn amount will disappear from the balance available for withdrawal from your account on 4fund.com, it will only be visible to you.

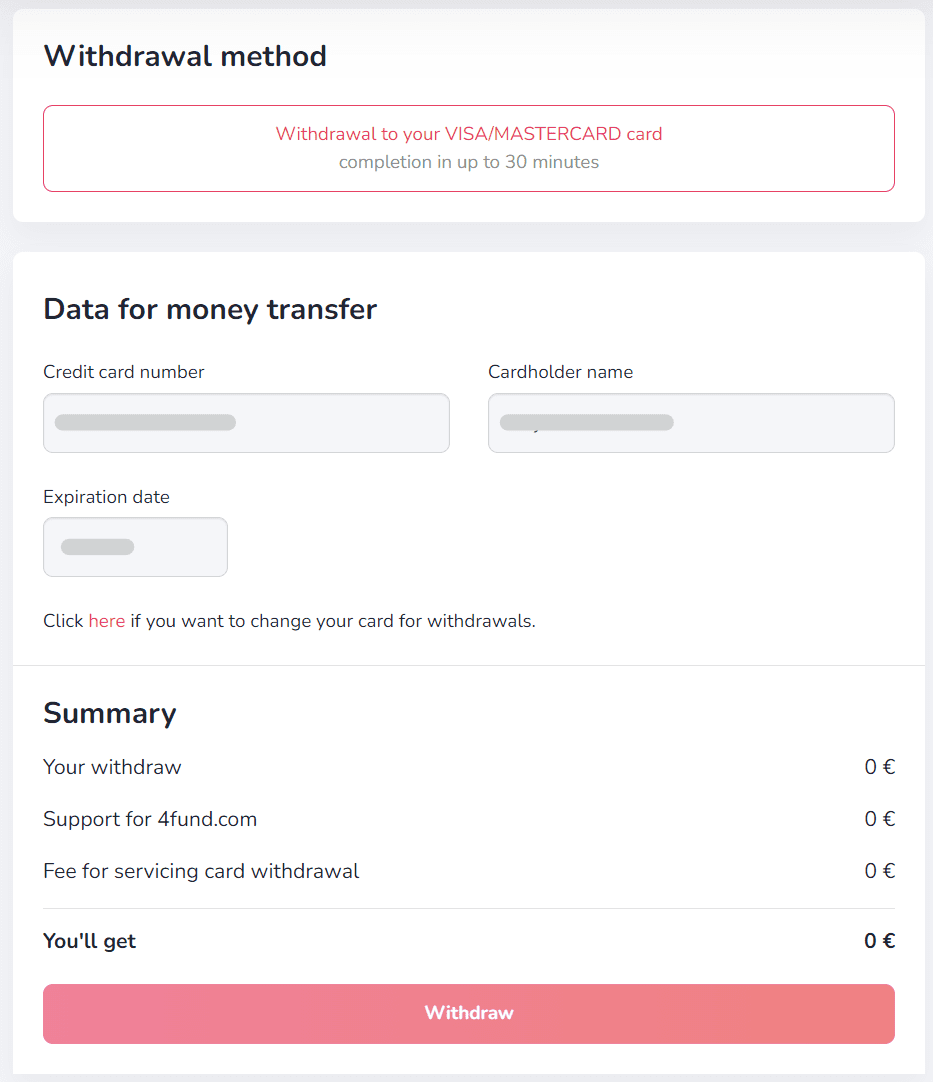

Withdrawn funds will be credited to your verified payment card almost immediately after requesting a withdrawal through your profile. Additionally, you can also make a standard withdrawal to your own bank account, but please note that this may take a little longer. If you wish to proceed with this option, please contact us and we will guide you through this process.

Of course! Donations from abroad can be made regardless of the currency, from anywhere in the world - your donation will be automatically converted by the bank and will go to the fundraiser in euro.

For security reasons, we apply a withdrawal lock in three situations:

- if the balance of a fundraiser exceeds EUR 5,000

- if the user raises over EUR 12,500 in total on their profile (total of all fundraisers combined)

- if we receive information of abuse regarding a given fundraiser or we ourselves have doubts about its legality - regardless of the amount raised in it

If withdrawals from your fundraiser have been blocked, regardless of the reason, we will inform you by e-mail what you need to do to unlock the possibility of withdrawals - so check your email carefully (including the SPAM folder).

If you've donated to a fundraiser, it may not be possible to receive a refund. This is because we transfer the funds raised to the page owner directly. However, you can contact the Organiser of the fundraiser with a request for a refund, using the 'Ask the Organiser a question' button.

If you have helped power 4fund.com with an optional support by mistake, please write to our help desk to request a refund.

We want the use of our portal to remain free of charge, therefore we are unable to provide payment via PayPal. There are other available payment methods - i.e. Apple Pay, Gpay, Visa/Mastercard payments, iDeal, Bancontact, Sofort, Skrill and more!

To donate funds to the selected fundraiser, just press the 'Donate' button on the fundraiser page, then choose your preferred payment method and complete the basic information in the payment form and you're done!

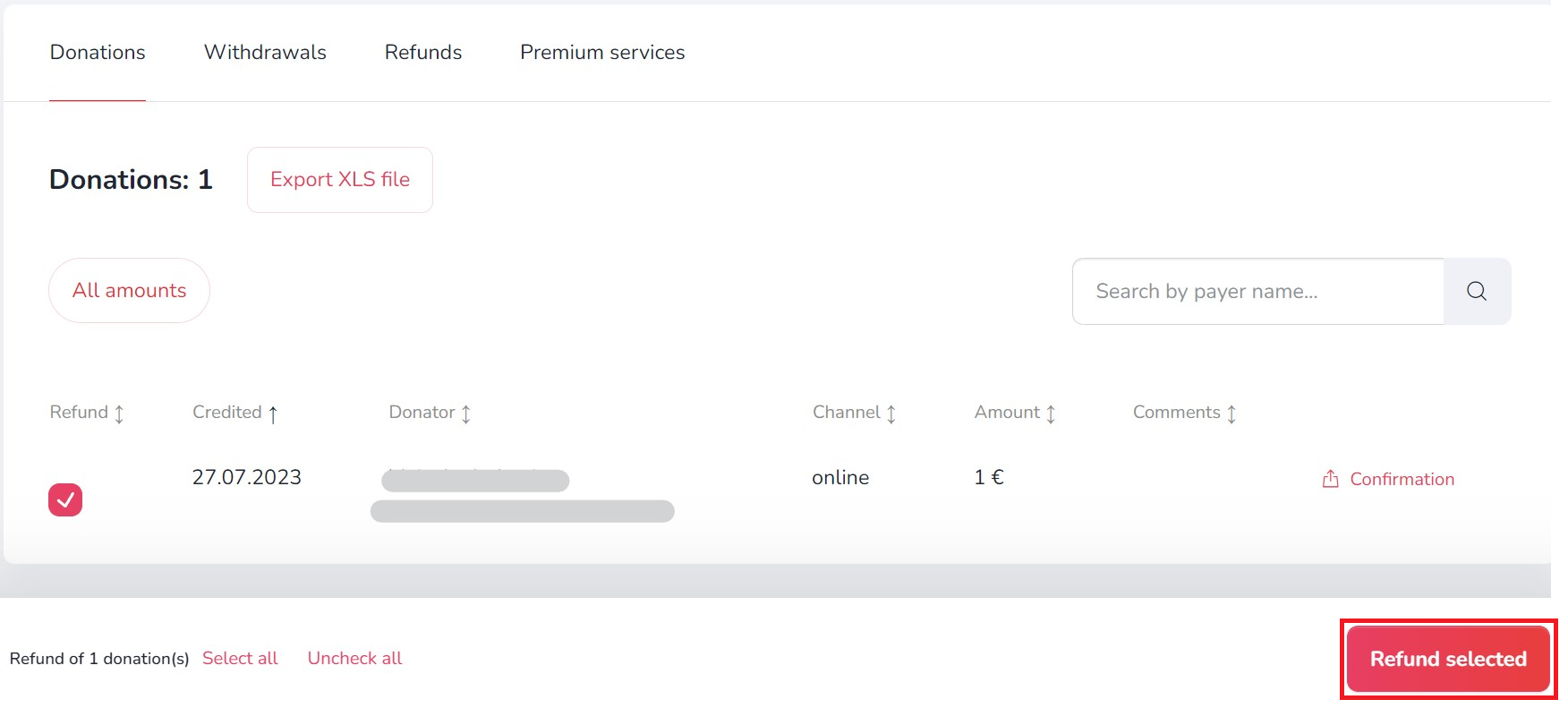

To make a refund, go to the 'My fundraisers' tab and then press the 'More' button on the selected fundraiser. Select 'Finances' from the drop-down menu:

Select the payments that you want to return to Donators from the list.

After selecting, press the 'Return selected' button at the bottom and decide who will bear the costs of return (EUR 0.5 for each return transfer).

Funds raised for the fundraiser can be withdrawn at any time. To do this, go to the 'Withdraw funds' tab, select the fundraiser from which you want to withdraw funds, click 'Pay out' button, enter the amount and the withdrawal details, and the authentication code sent to your e-mail address or phone number.

Ready! The funds should be credited to your verified payment card within a few minutes.

If you experience any issues with withdrawing funds to your card, please contact us, and we will guide you on how to withdraw funds via a traditional bank transfer to your account.

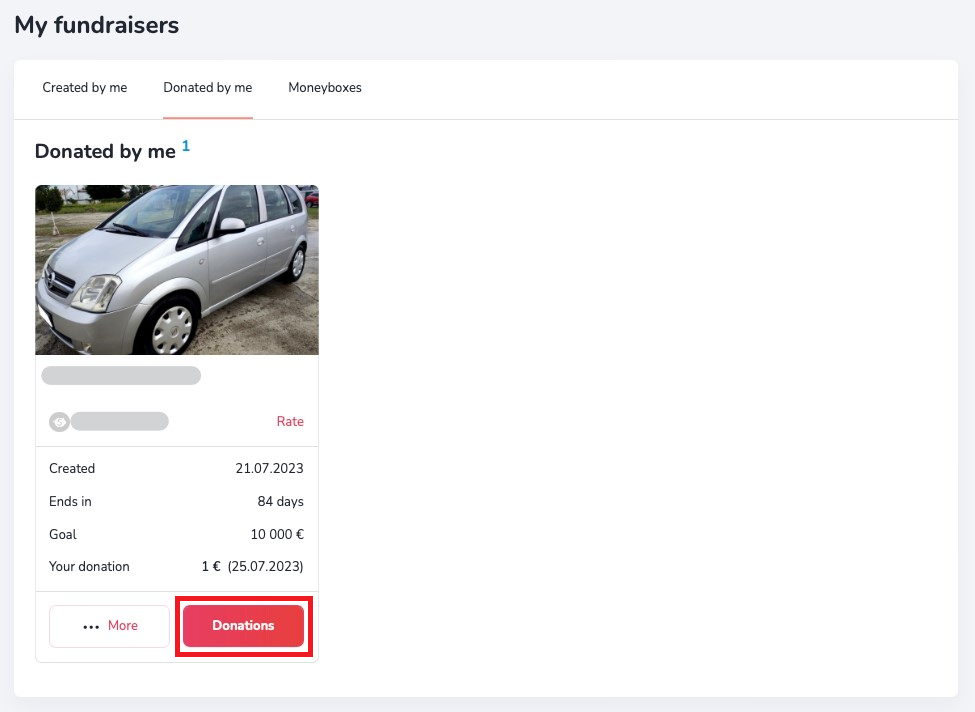

If you have done your donation correctly, you will receive an email confirming your donation. In addition, your payment appears in the 'Donators' tab on the fundraiser you've donated.

If you do not find your payment there, write to the Organiser of the fundraiser to check whether they have received your payment - you can do this by clicking on their name just above the image of the fundraiser, and then selecting the 'Ask the Organiser a question' option.

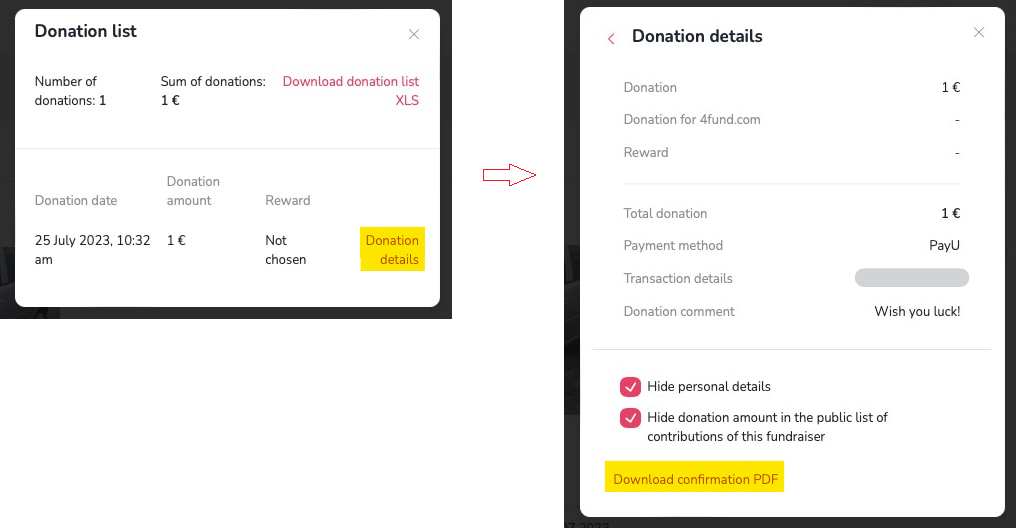

You will always receive confirmation of payment to the e-mail address provided when making the payment. In addition, you can download the confirmation after logging in to your user profile, going to the tabs: 'My fundraisers' - 'Donated by me', and then in the preview of a given fundraiser, selecting 'Donations' - 'Donation details' - 'Download confirmation PDF' (according to the following screenshot).

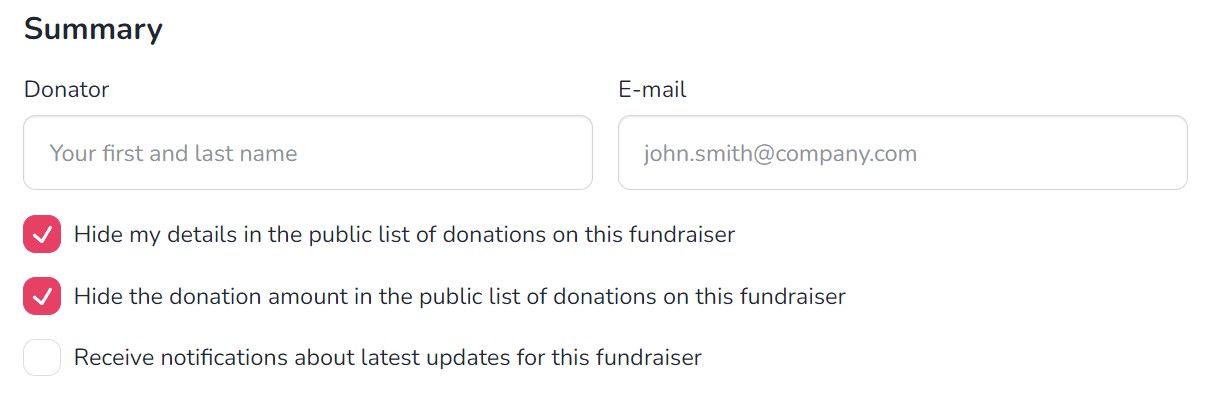

You can add your name or hide your details when making a donation. If you don’t want your name to be visible on the fundraiser page, check the box 'Hide my details in the public list of donations on this fundraiser' or 'Hide the donation amount in the public list of donations on this fundraiser' if you want to hide only the value of your donation.

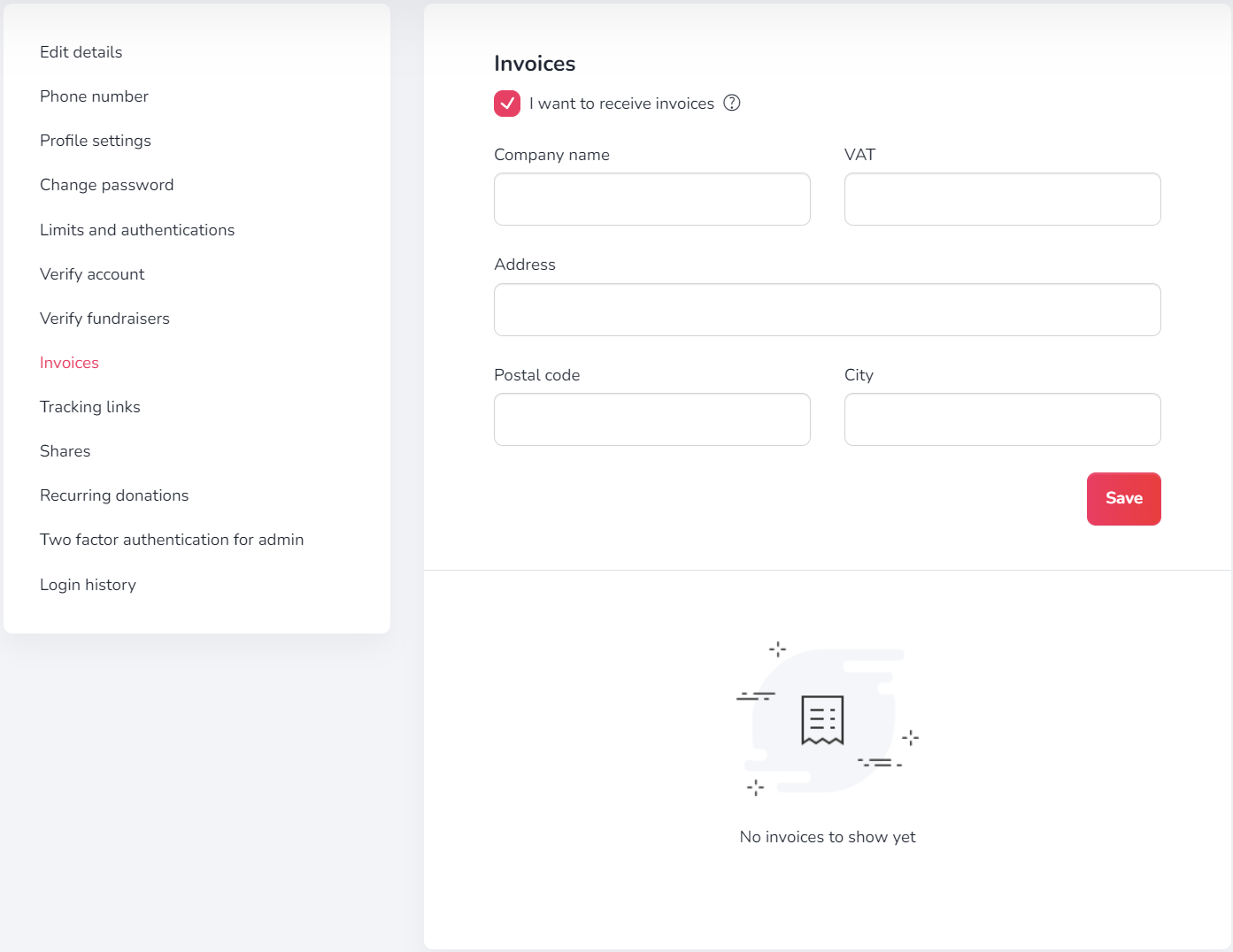

To receive invoices for purchased premium features, log in to your profile, go to the 'Settings' -> 'Invoices' tab and check the 'I want to receive invoices' checkbox.

It is not possible to issue invoices for services purchased before checking the checkbox. We also do not issue invoices for donations - if you need a confirmation of your donation, please check: Where can I find confirmation of my donation?

Our core services are completely free, but as an Organiser you can also purchase various promotion and enhancement options. You can check their prices below.

| Premium services* | Duration | Price |

|---|---|---|

| Individual website address (alias) | 7 / 14 / 30 / 365 days | 2 / 3 / 4 / 10 euro |

| Promoted fundraiser | 7 / 14 / 30 days | 5 / 8 / 10 euro |

| Highlight of promoted fundraiser | 7 / 14 / 30 days | 7 / 12 / 20 euro |

| Package (individual website address, promoted fundraiser and highlight) | 7 / 14 / 30 days | 10 / 15 / 25 euro |

Donating on 4fund.com is simple and convenient. Follow these steps:

- Choose a Fundraiser: Browse through the fundraisers catalogue on the 4fund.com platform and select the one you wish to support.

- Click "Donate": On the chosen fundraiser's page, click the "Donate" button.

- Enter Your Amount: Decide on the amount you want to donate or enter it in the designated field.

- Select Payment Method: Choose from a range of secure and convenient payment methods, including Visa and MasterCard card payments, Apple Pay, GPay, iDeal, Bancontact, Sofort, Skrill, and more!

- Complete the Transaction: Follow the prompts to finalize your donation.

Your donation will be processed immediately, ensuring that the funds reach the fundraiser quickly and securely.

Other

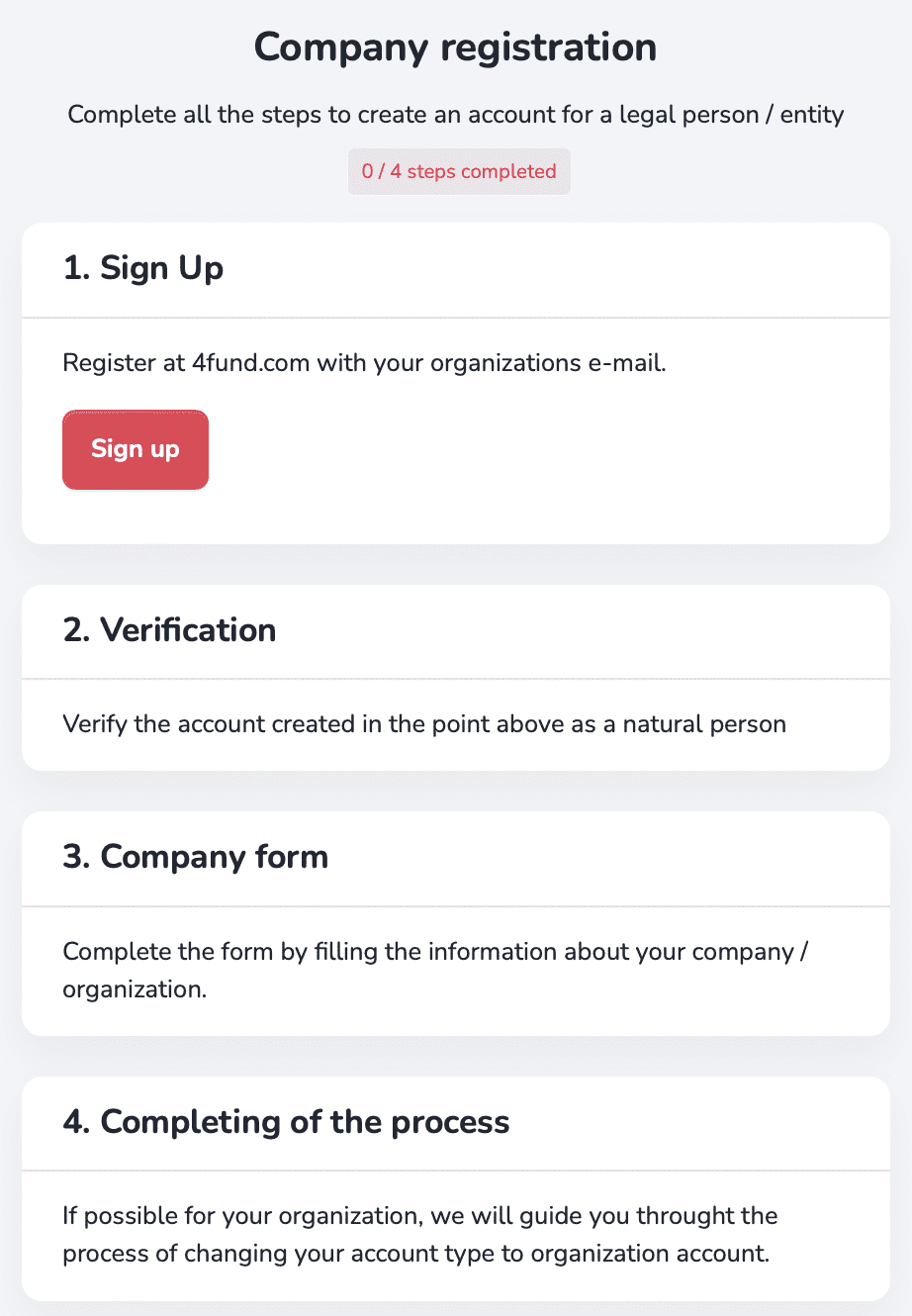

To let us know that you want to create a corporate account for your organization, simply click here and complete the brief application form. Our customer support team will then (if we accept your request) reach out to you via email and assist you step by step to go through a manual company onboarding process.

If you are having trouble signing in or simply cannot remember your password, click the 'I forgot my password' button in the login window. After that, you will receive an email with an active link to create a new password.

Make sure that the email sent to your inbox was sent from [email protected].

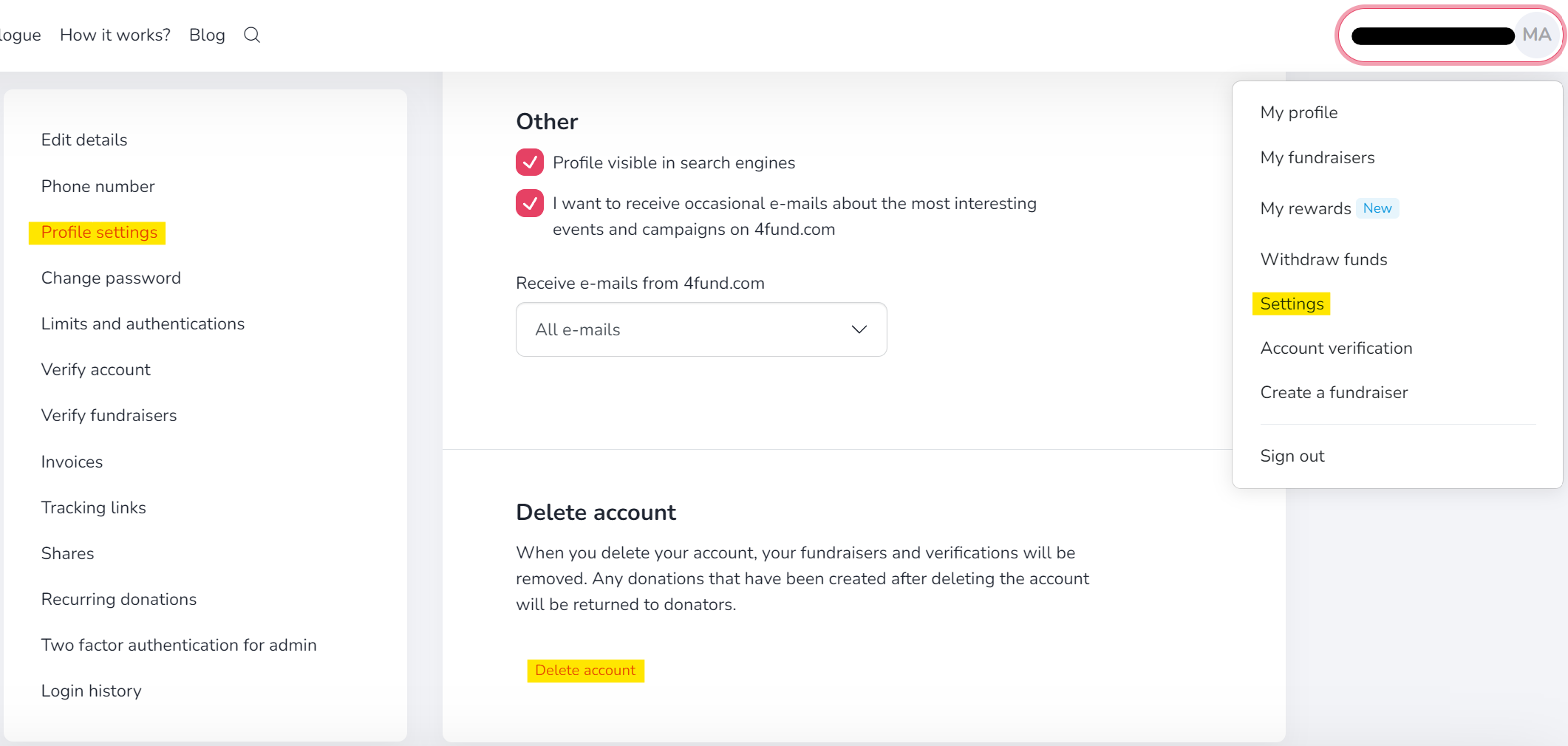

To delete a profile, go to the 'Settings' tab.... -> 'Profile Settings'. A little lower you will find a button to delete your account.

Our public API is available at https://4fund.com/api/v1/public/doc. If you wish to receive access, please send a request via the form in the contact section.

After reviewing your application and the planned use of the API, the service will assign a dedicated 'access_token'.

If you have any suggestions/new endpoints, please let us know. At the same time, we warn you that endpoints supporting key functions such as:

- login/registration/reset user password

- payment

- withdrawal of funds

- user verification

- premium purchase

- checking the payout balance

are not publicly available and may only be made available to those that offer various services based on access to bank accounts, e.g. data aggregation or personal finance management. Among them, there may be only banks, payment institutions or other providers that have an appropriate license for this type of service (due to the regulations contained in the Payment Services Directive 2 - an EU directive that introduces a single payment market in EU countries).

To change your email address, email us at [email protected] with your request and we will guide you step-by-step through the email address change procedure.

To sign up for the newsletter and receive the latest articles, event invitations and summaries of the most interesting fundraisers, click here and leave us your email address >>>SIGN UP.

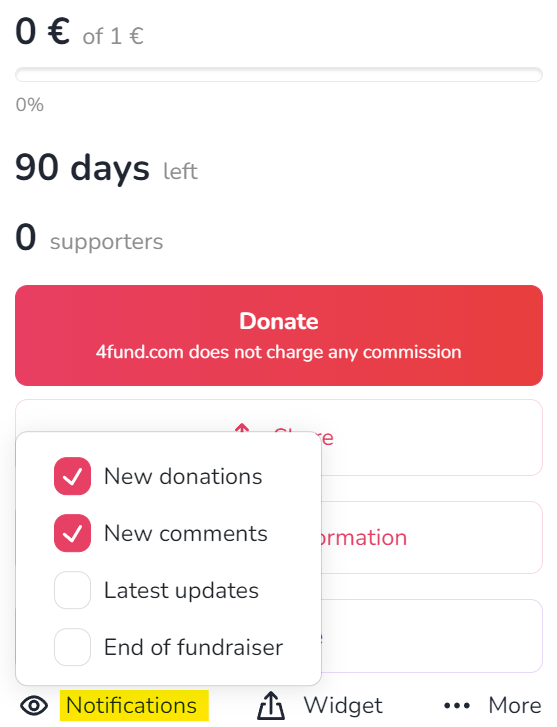

You can receive notifications about new donations, comments, news, and the end of fundraisers in your e-mail address. To enable notifications, click the 'Notifications' button on the fundraiser page that you are interested in and check the appropriate checkboxes

If you want to unsubscribe from the newsletter or from receiving notifications about a specific fundraiser, click on the link in the footer of the message.

If you want to withdraw your consent to push notifications, look for this option in the settings of your web browser.

Adhering to our regulations, it is not possible to change the Organiser to another person or organisation. Nor is it possible to change the Organiser's data - the data must be consistent with the data from the form, payment card and identity document.

However, in exceptional cases (e.g. change of surname) it is possible to correct the profile data - please contact our customer service department for this.

Other

Below you will find documents - templates of powers of attorney and consents that may be useful during the profile and fundraiser verification process:

- Consent to run the fundraiser on my behalf and to process my medical records (download)

- Consent to process my medical records (download)

- Consent to run the fundraiser on the behalf of the person under my care and to process their health records (download)

- Consent to run a fundraiser on my behalf (download)

- Consent to run a fundraiser on the behalf of a person under my care (download)

- Consent to run a fundraiser on behalf of an institution in which I am employed/which I manage (download)

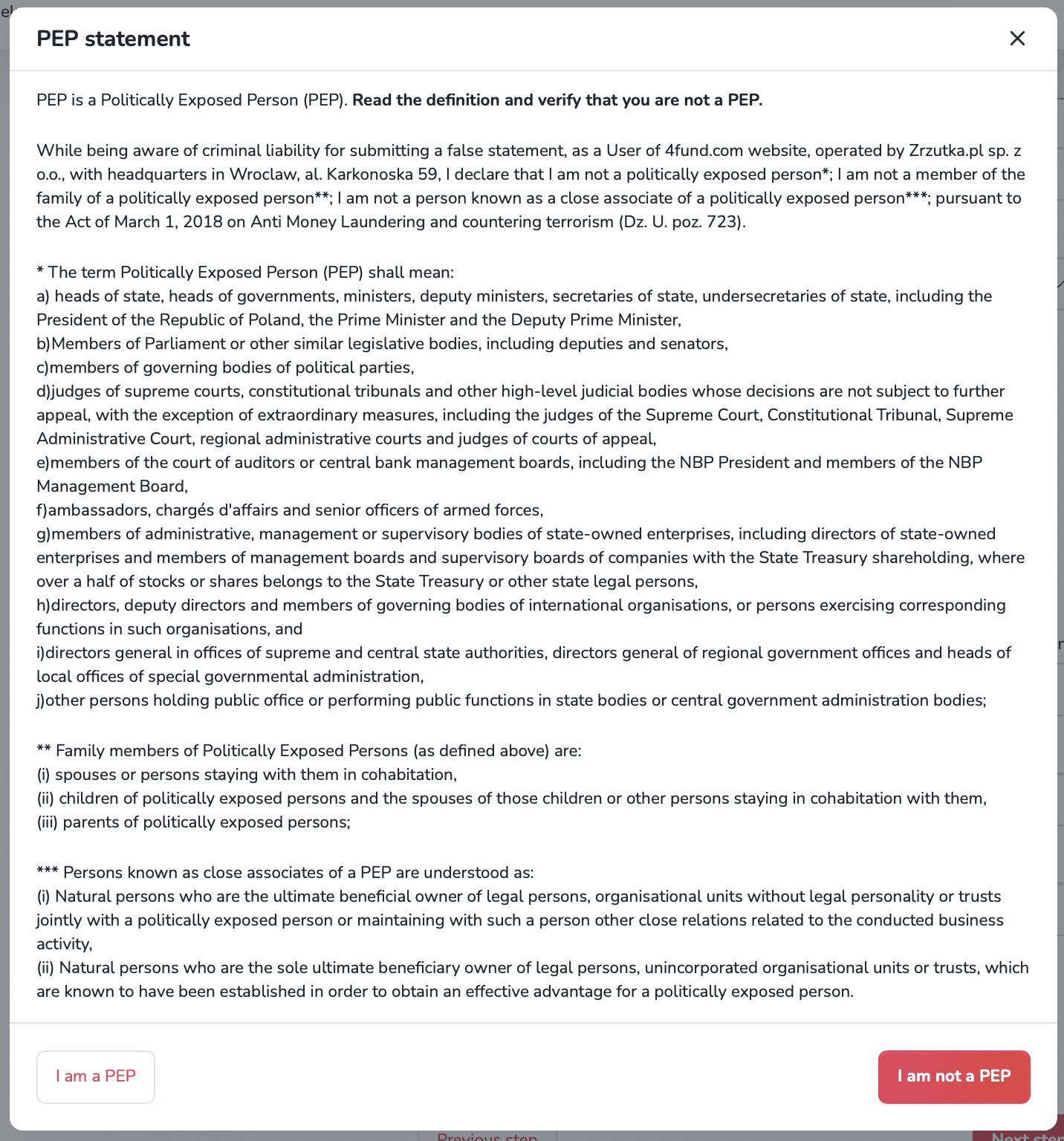

- Declaration of PEP status (download)

- Declaration of sources of assets - PEP (download)

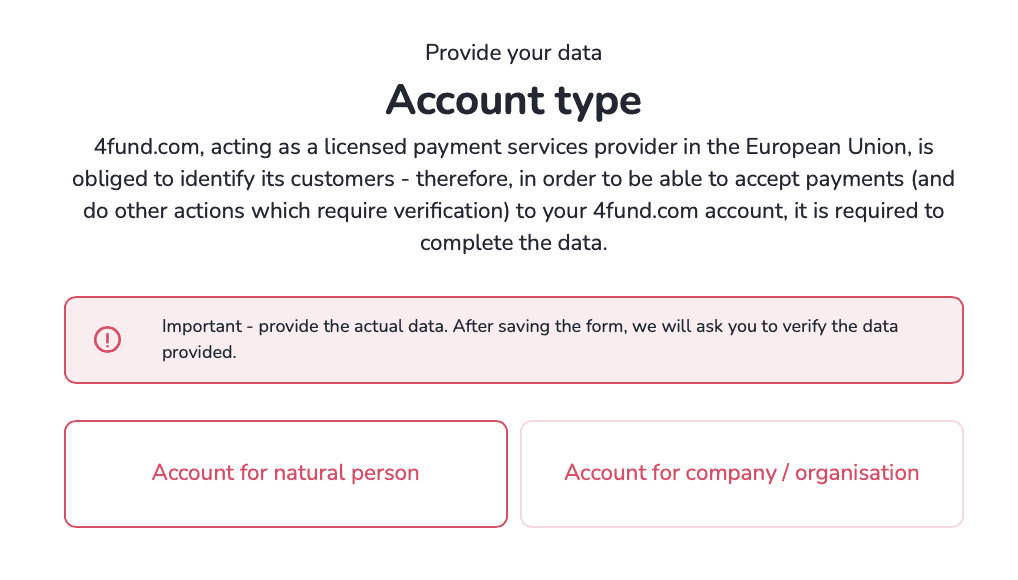

Verification of your profile consists of two main steps: filling out the identification form and submitting the necessary documents.

To start the verification process, select 'Account verification' from the drop-down menu in the top right corner of the page.

In the first step, you will be asked to choose the type of account.

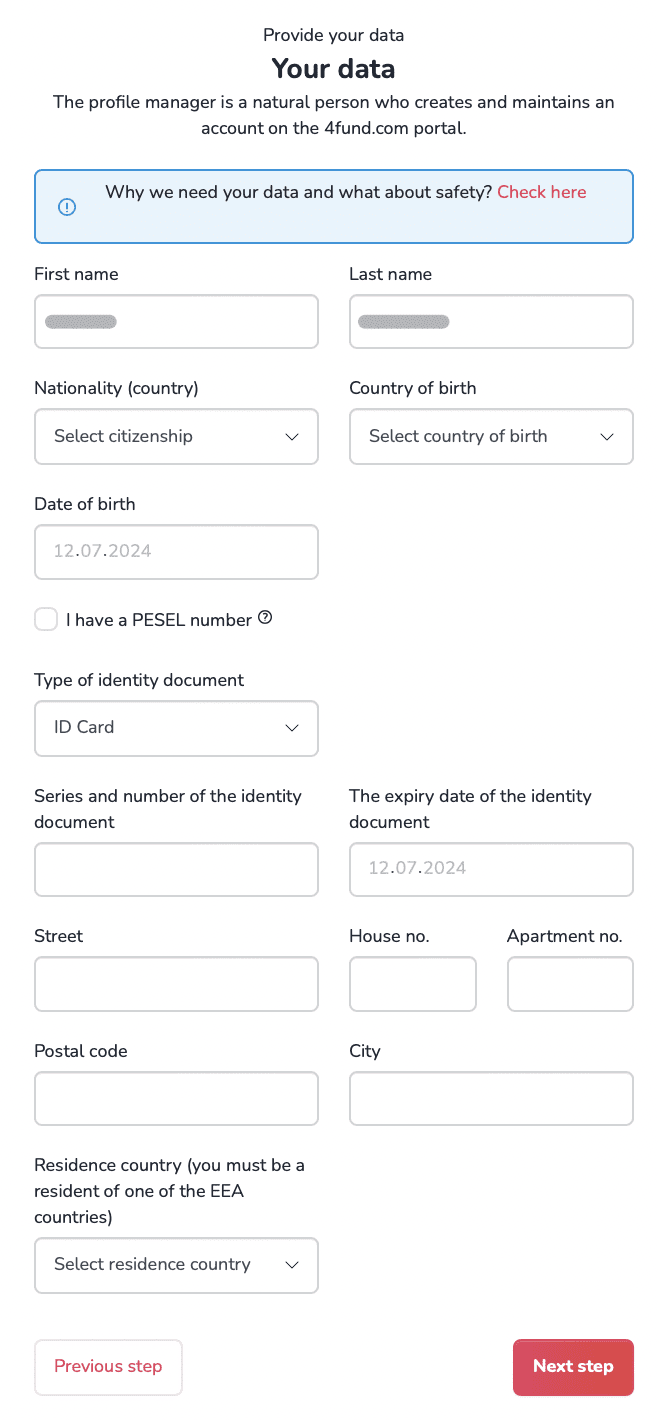

Next, an identification form will appear, where we will ask for basic information such as your name, personal identification number, address, and the number, and expiration date of your identity document.

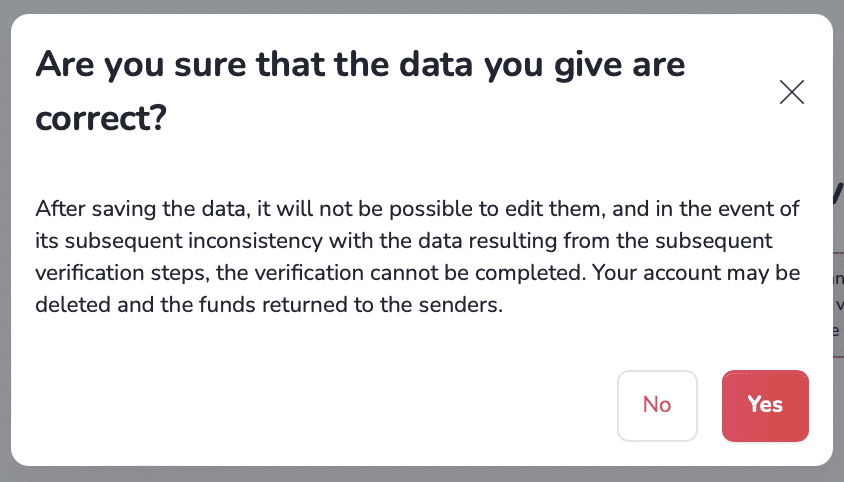

Important - make sure to enter accurate information in the form. After you save the form, we will ask you to verify this information, and you will not be able to edit it later.

After filling out the form and clicking 'Next Step', a PEP statement will appear. This is a declaration about whether or not you hold a prominent public position.

In the following step, we will summarize the information you provided. Read it carefully and make sure there are no errors, as you will not be able to edit the data after saving the form.

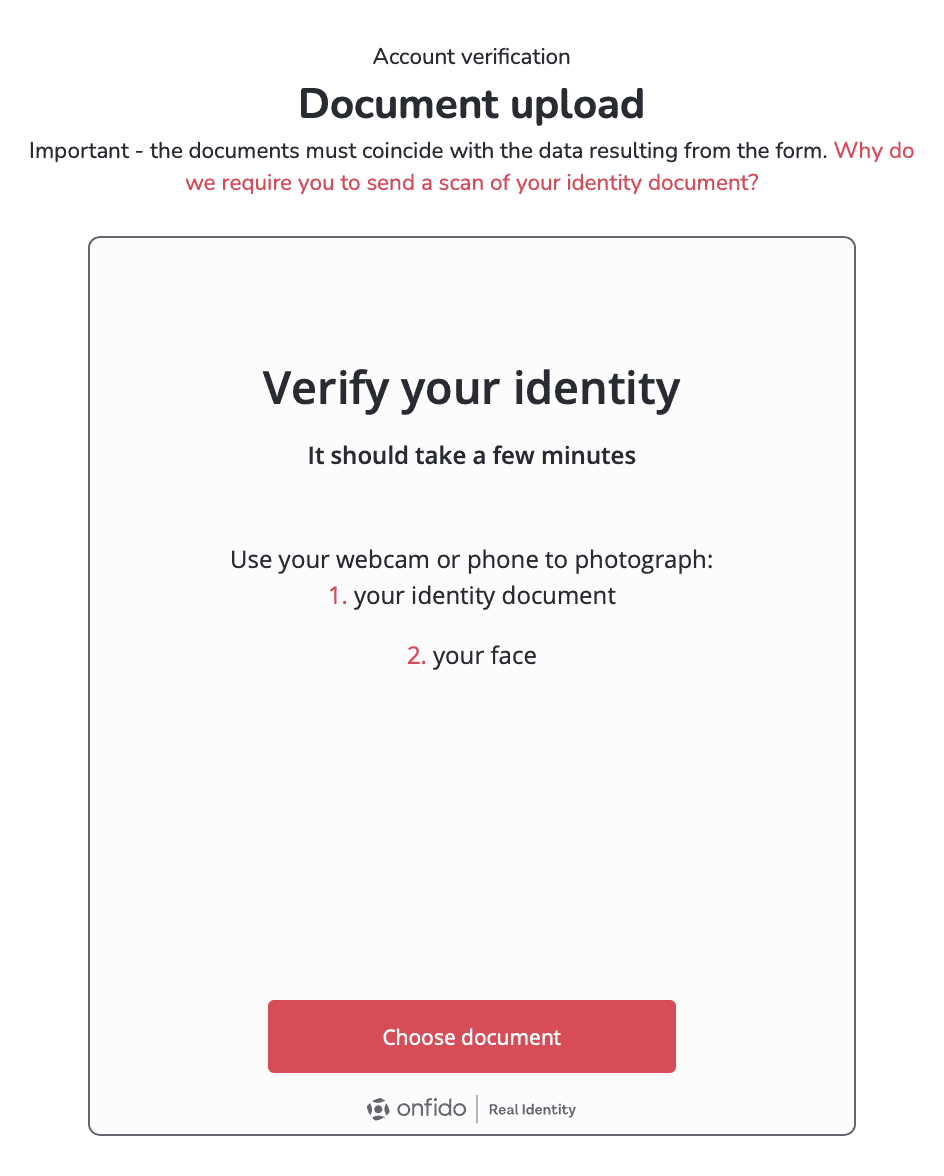

Once the data is saved, your fundraising campaign will be automatically activated for 30 days. During this time, you must complete the account verification. To make withdrawals and continue your fundraising campaign, you will also need to submit a photo of your identity document and a video of your face.

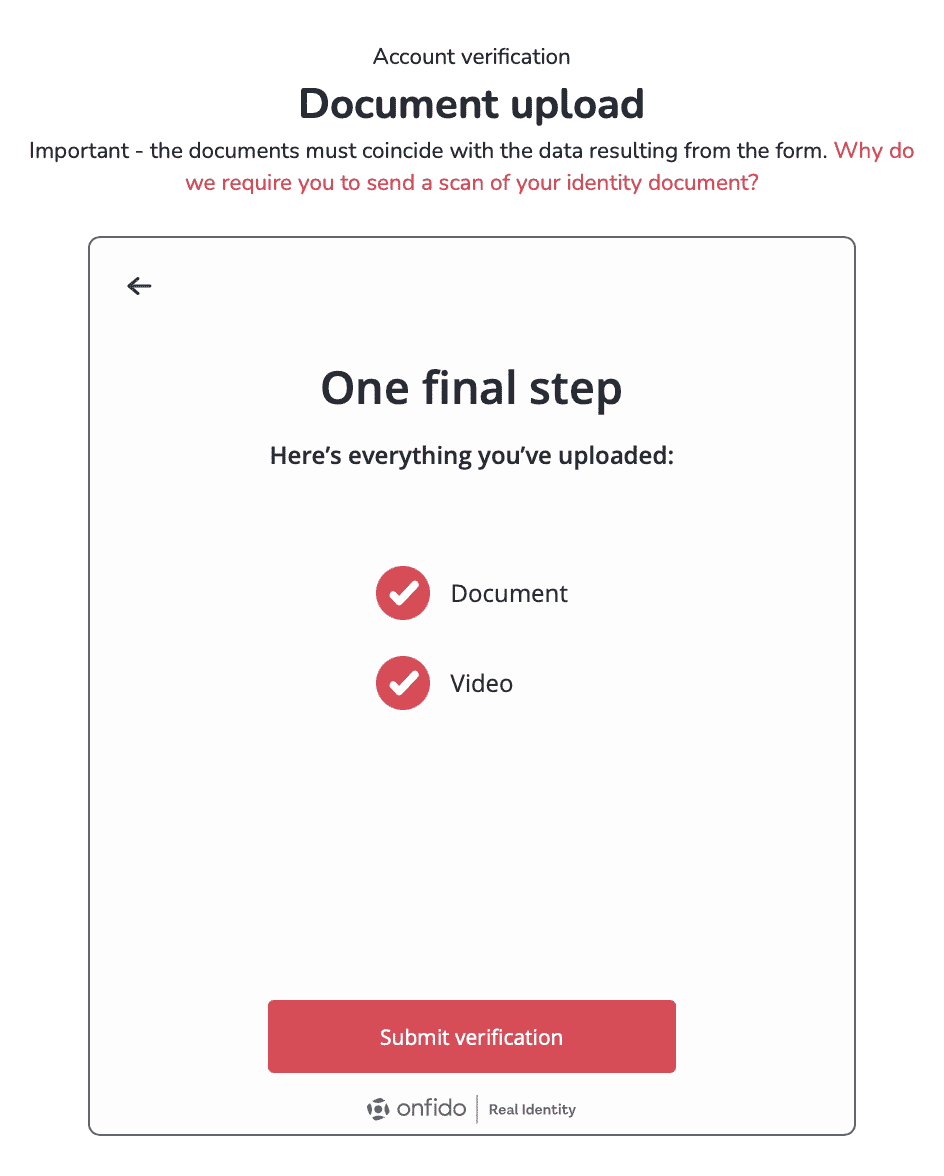

The second and final step of verification is uploading the necessary verification documents. Follow the on-screen instructions, and the tool will guide you through the entire process quickly and efficiently.

For private account verification, you need to upload photos of your identity document - either an ID card or a passport - and record a video of your face. The information on the documents must match the information provided in the identification form. Ensure the photos are of good quality, and that none of the document edges are cut off.

And done! If all the information is correct, your account will be automatically verified within a few minutes. If there are any issues with the verification, we will notify you via email, detailing any additional information required.

As a certified Payment Services Provider, we ensure the highest security of your data.

The user profile verification process can be completed in just a few minutes.

However, when it comes to verifying the description of your fundraiser, our team must check the attached documentation. We always try to speed up the process as much as possible, but please bear in mind that checking the documents can take up to two working days depending on the complexity of the fundraiser and the information provided by the Organiser.

During the verification process, you will be asked to send a scan/photo of your identity document: identity card (both sides) or passport (photo side). The details/photo on the document must match the details (your image) of the video taken during the verification (biometric verification).

We take data privacy and security very seriously and we have measures in place to protect your data - you can read more about this here.

If you are waiting for your authentication code and it hasn’t arrived yet there are some things you can do:

- Check your spam folder: If you find a message with a code in the SPAM folder, mark it as a safe message so that the problem does not arise again in the future. Also make sure that your mailbox is not full.

- Wait a little longer: It is rare but possible that there could be a delay.

- Request a new code: If you have waited more than 5 minutes then request a new code.

- Switch to an SMS authorisation method: the authorisation method can be changed under 'Settings' -> 'Limits and authorisations' -> 'Authorisation method' -> 'SMS message' (alternatively, if you have problems receiving codes sent in SMS - change the authorisation method to e-mail).

The codes are automatic messages. Each code is only valid for 5 minutes from the moment it is generated in our system, so if this time has already expired, you must repeat the action on our website and generate a new code. In addition, each time a code is generated, the previously submitted code is deactivated. Therefore, if verification attempts have been made several times, please make sure that the code you enter comes from the last message received.

Yes, if you are using 4fund.com then you must provide a government issued ID in order to verify the profile. This is a standard part of the verification process. It is necessary to send a scan or a photo of the identity document of the profile owner - this can be an identity card or passport.

Your data is secure with us - documents added via the form are attached using an encrypted connection (256-bit GeoTrust certificate).

PEP is an acronym for Politically Exposed Persons. As a national payment institution, we are obliged to confirm the identity of our users during account creation and to identify persons in positions of prominence (i.e. minister, president, senator, etc.), which is why the question about PEP status is included in the data form on your account.

If this is the case, please contact our customer service at [email protected], so that editing is unlocked and you can correct your answer on the form.

Verification of the fundraiser description is only necessary in four situations:

- at the launch of the fundraiser promotion,

- when the balance of a specific fundraiser exceeds EUR 5,000,

- when you collect a total of more than EUR 12,500 on all your fundraisers

- when we receive a report of abuse on a particular case or we have doubts about its reliability, regardless of the amount collected.

In order to verify your fundraiser description you can:

- use the tab 'Verify a fundraiser' available in your account settings on 4fund.com or

- you can also verify your fundraiser from the level of editing a chosen fundraiser - to do this log in to your account and go to the very bottom of the fundraiser view, then upload the required documents using the designated field.

Other

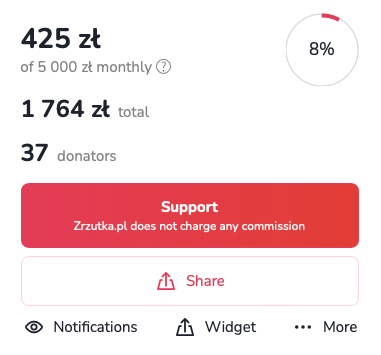

A recurring fundraiser, in addition to a single donation, allows regular monthly donate for the Organiser. The Organiser of such a fundraiser has the chance to create a steady, recurring source of income, and Donators can receive regular rewards for their donations, i.e. access to the author's content.

At 4fund.com, neither you nor your Donators need to have a PayPal account. You can donate to the fundraiser by card and the most popular online methods. All this for free and without commission! 100% of the funds raised will be paid out whenever you want.

Try it now on https://4fund.com/recurring!

The recurring fundraiser differs slightly in appearance from the regular fundraiser - the amount of funds raised is illustrated in the form of a progress wheel, and the amounts are given in two versions - total and monthly.

A recurring donation works in a similar way to a standing order at your bank. By selecting the recurring donation option, you set an amount that will be automatically debited from your card each month and transferred to the account of the selected fundraiser.

As a logged-in user, you can transfer such fixed donation to those fundraisers that are recurring. You can deactivate automatic donations at any time in the settings in your user profile.

If there is not enough funds in your account on the payment date, the system will make a repeated attempt to transfer funds for 3 consecutive days. If there is not a sufficient funds in your account within this time, the system will not attempt to make the donation again until the following month.

If you no longer wish to donate a particular fundraiser, the option to cancel donate can be found in your account settings ('Settings' tab → 'Recurring donations' tab → 'More' → 'Disable')

Recurring fundraisers are most often used by online creators, i.e. youtubers, bloggers, streamers, musicians, podcasters or photographers. Donators pay monthly sums into the account of the Organisers, who get the opportunity to develop their passions and talents, and Donators get great rewards and satisfaction from donating interesting projects! You use the recurring fundraiser for free - we do not charge any fees or commissions.

The recurring fundraiser is therefore a solution for anyone who has something to offer their audience - in a subscription model, of course. It is also a place for Donators who, by donating to interesting projects, can receive unique rewards!

Creating a recurring fundraiser is as simple as creating a regular one. You can do this by entering the goal of your new fundraiser in the form at https://4fund.com/recurring. Once you have created your fundraiser, don't forget to create an interesting description and add images. You can also offer unique rewards to Donators.

Other

To verify a corporate account, please follow the detailed steps outlined in our blog post. This guide will walk you through the entire process step by step.

You can read the full instructions here.

If you have any questions or need further assistance, feel free to contact our support team.

Fundraising for a nonprofit organisations has never been easier! Create a fundraiser on behalf of the organisation you care about most. Support their cause and make a difference now! Check out the blog article.

Or perhaps you run a nonprofit organisation? Would you like other users to help you achieve its goals? Give them the opportunity to create fundraisers on behalf of your organisation! Read our guide for NGOs and follow three simple steps to be listed in our NGO catalogue as a fixed beneficiary!

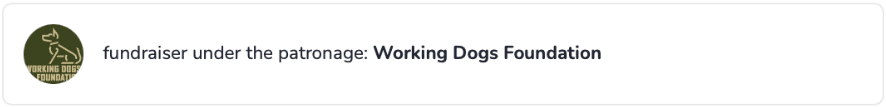

For fundraisers organised on behalf of an organisation, the organiser sets up and manages the fundraiser, but the donated funds go directly to the beneficiary organisation. In this type of fundraiser, you can find the name and logo of the organisation just below the fundraiser's cover photo.

On 4fund.com you can easily, quickly and safely create a fundraiser on behalf of an NGO you care about. All you have to do is go to https://4fund.com/patronized-fundraising, fill in a short form and choose an organisation from the catalogue. Wait for the selected NGO to approve your fundraiser. And that’s it!

After the organisation approves your fundraiser, you can start raising funds! You don't have to worry about billing - all collected funds will go directly to the charity organisation for which you've created a fundraiser.

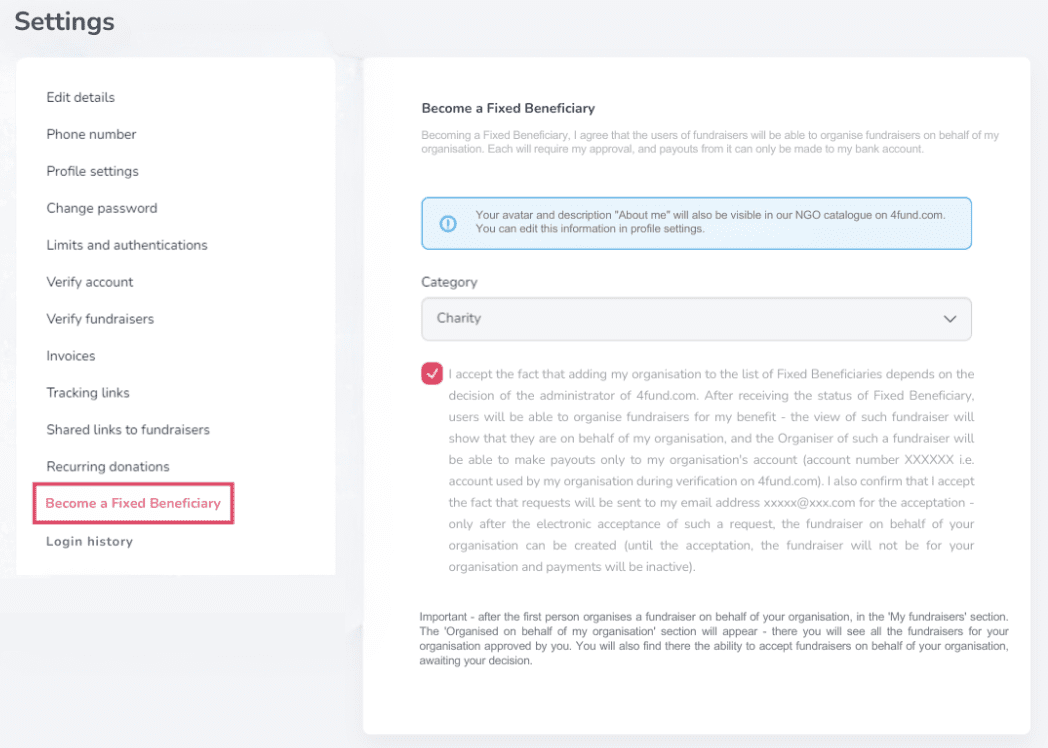

Become a Fixed Beneficiary is all you need to allow others to create fundraisers on behalf of your organisation. The first step is to have a fully verified profile for your foundation or organisation. If you haven't done this yet, you can register your organisation. Once your account is verified, you will find the 'Become a Fixed Beneficiary' tab in your account settings.

For more information, see our guide on fundraisers for NGOs.

As a Fixed Beneficiary, you will receive a dedicated landing page. Additionally, a box will appear on your profile, allowing anyone to set up a fundraiser on your behalf.

Other

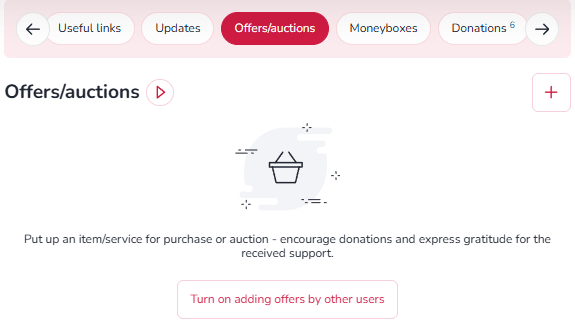

On 4fund.com, "Offers" and "Auctions" are innovative features that allow fundraisers to raise money by selling or auctioning items and services. This approach enables supporters to contribute financially while receiving something in return, enhancing engagement and providing additional fundraising avenues.

Offers

- Buy Now: Supporters can purchase items or services at a fixed price.

- Categories: Offers span various categories, including fashion, books, electronics, crafts, digital downloads, and unique experiences.

- Digital Delivery: For digital products like e-books or vouchers, buyers receive instant access upon payment.

- No Fees: 4fund.com does not charge commissions, ensuring that 100% of the proceeds go directly to the fundraiser.

Auctions

- Bidding: Supporters can bid on items or services, with the highest bidder winning the auction.

- Notifications: Participants receive email alerts if they are outbid or when an auction is nearing its end.

- Transparency: All auctions are managed directly on the platform, eliminating the need for external communication.

- Support for Causes: Funds from auctions go entirely to the associated fundraiser, allowing supporters to contribute meaningfully.

Adding offers or auctions to a fundraiser on 4fund.com is a straightforward process that enhances fundraising efforts by providing supporters with tangible incentives. Here's how you can add offers or auctions as an organizer:

1. Log In and Access Your Fundraiser:

- Sign in to your 4fund.com account.

- Navigate to your fundraiser page.

2. Add an Offer or Auction:

- Scroll to the "Offers/Auctions" section.

- Click the "+" button to open the form for adding a new offer or auction.

3. Fill in the necessary details:

- Title and Description: Provide a clear and concise title and description of the item or service.

- Category and Condition: Select the appropriate category and specify if the item is new or used.

- Images: Upload images to showcase the offer (optional but recommended).

- Purchase Mode: Choose between "Buy Now" or "Auction."

- Price and Quantity: Set the price and specify the number of items available.

- Delivery Method: Select the delivery option—personal collection, postal dispatch, or email (for digital items).

- Attachments: For digital products, add downloadable files that buyers will receive upon purchase.

- Contact Information: Optionally, provide a phone number for buyer inquiries.

Auctions on 4fund.com provide a dynamic and engaging way to support fundraisers by bidding on unique items or services. All proceeds from these auctions go directly to the associated fundraiser, with no platform fees or commissions involved.

How to Participate in Auctions

- Discovering Auctions

- Fundraiser Pages: Navigate to a specific fundraiser and scroll to the "Offers/Auctions" section beneath the description to view available auctions.

- Auction Catalog: Browse the Offers and Auctions catalog to explore a wide range of items across categories like art, experiences, collectibles, and more.

2. Placing a Bid

- Select an Item: Click on the auction item you're interested in.

- Enter Your Bid: Input your bid amount in the designated field and click the "Bid" button.

- Account Requirement: If you're not logged in, you'll be prompted to sign in or create a free account. Account creation is quick and doesn't require verification to participate in auctions.

3. Notifications and Updates

- Outbid Alerts: Receive email notifications if another user places a higher bid, allowing you to stay competitive.

- Auction Reminders: An email reminder is sent one hour before the auction ends, ensuring you don't miss the opportunity to place a final bid.

4. Winning and Payment

- Winning the Auction: If your bid is the highest when the auction concludes, you'll receive a confirmation email.

- Payment Window: You have 24 hours to complete the payment through the platform.

- Fund Allocation: The full amount of your payment is transferred directly to the fundraiser's account.

5. Item Delivery

- Receiving Your Item: After payment, the seller (either the fundraiser organizer or a verified contributor) will contact you to arrange the delivery of the item or service.

By posts, you can provide people who donated your fundraiser specific information - such as, for example: access codes or links to your content (photos or videos, access to training courses you conduct, passwords to content premium you offer and others). Posts are assigned to offers - to add posts, you must add at least one offer to your fundraiser first.

You can provide your Donators with specific information such as links to content, access codes (photos or videos, access to training courses you conduct, passwords to content premium you offer and others) through posts. You simply add minimum one offer to your fundraiser.

Other

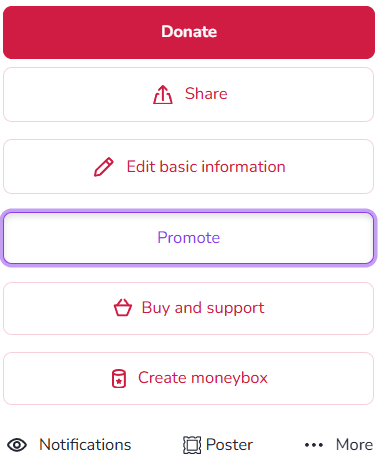

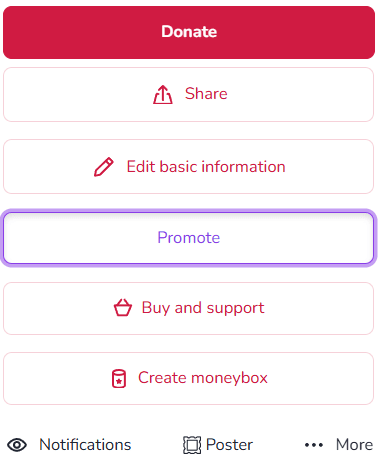

You can buy premium features or you can use the Facebook remarketing advertising option. To see the details of the aforementioned adverts after logging in to your account, go to your fundraiser and select the 'Promote' option.

Our core services are completely free, but as an Organiser you can also purchase various promotion and enhancement options:

- Individual website address (alias)- everyone will easily remember the address of your fundraiser thanks to our friendly link - for example: 4fund.com/your_name.

- Promoted fundraiser [will be available soon]- with this option your fundraiser will be displayed here

- Highlight of promoted fundraiser [will be available soon] - thanks to it, your fundraiser will be displayed in the highest possible position in our catalogue

The cost depends on the length of time for which each premium service is purchased and is available in the 'Promote' tab. You can also buy a package of all three options at an attractive price!

There are several ways to promote your fundraiser:

- Share the link on your social media - Instagram, Facebook etc.

- Email your family and friends and ask them to share the link too.

- Reach out to local media and share your story.

- You can also embed a thumbnail of your snapshot in any external page using the 'Create a widget' option, print a poster or QR code - you will find all these functions by clicking 'More' button on your fundraiser.

Once you have logged into your account, go to your fundraiser and select the 'Promote' option. Remember to make your payment after selecting the additional features you are interested in. You can pay from the balance of the fundraiser or via online payment.

There are several ways to share a fundraiser with your friends. Here are some ideas:

- Share the link: You can share the link of the fundraiser with your friends through social media platforms like Facebook, Twitter, Instagram, or through messaging apps like WhatsApp or Telegram. Just copy the link and share it with your friends.

- Share via email: You can also send an email to your friends with the link of the fundraiser.

- Organise an event: You could organise an event like a fundraiser party or a charity walk and invite your friends to attend.

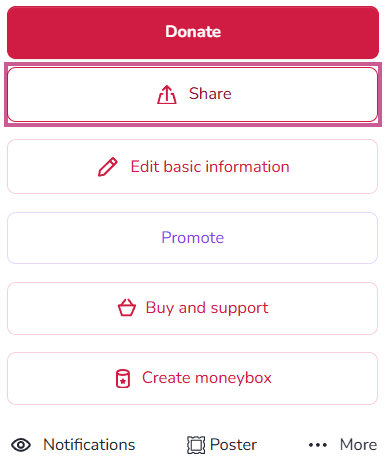

You can share any fundraiser by copying the url or by clicking on the dedicated 'Share' button on the fundraiser page. Your sharing makes a big difference - fundraisers shared on different channels raise as much as 6.5 times more funds on average!

Due to the very large number of requests, in our social media we only promote fundraisers selected by us. We encourage you to take a look at the articles in which we have collected tips to increase the effectiveness of fundraisers:

The promoted fundraiser feature is paid extra and you can purchase it by clicking the 'Promote' button on your fundraiser. The promoted fundraiser will be displayed here, and can also appear among fundraisers advertised on Facebook and Google Ads.

Are you looking for a fundraiser?

No answer to your question above?

Log in to write to us via the contact form.